UK govt to nationalize struggling lender

|

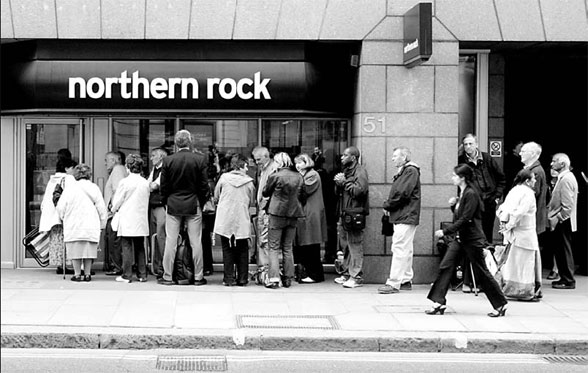

Northern Rock customers queue outside the bank's Moorgate branch in London. Bloomberg News |

UK Prime Minister Gordon Brown faced a political and public backlash yesterday after his decision to take ailing bank Northern Rock Plc into public ownership, the first UK nationalization since the 1970s.

The government announced new legislation allowing it to take over Britain's fifth-largest mortgage lender after rejecting two private sector-led bids on Sunday and ending five months of uncertainty over Northern Rock's fate.

Even temporary nationalization, however, will carry political and financial risks for a government already tarnished by the debacle, as it links its fate to a mortgage bank at a turbulent time for the United Kingdom's housing market, with home repossessions, bad loans and job cuts all set to rise.

It is also facing the threat of a drawn-out legal battle with shareholders, who stand to lose most or all of their investment. Northern Rock has borrowed about 25 billion pounds from the Bank of England since the global credit crisis last year wrecked its funding model, sparking the first run on deposits at a British bank for some 140 years.

With a national election due by May 2010 at the latest, turmoil over the past five months has dented both the Labour government's popularity and the prime minister's reputation as a guardian of financial stability.

Shareholders reacted with anger as the suspension of Northern Rock shares left them unable to sell their stock.

"We will wait to see the details of the nationalization bill and after that we will pursue all legal and non-legal actions available to us to secure value for shareholders," Jon Wood, founder of the bank's top shareholder SRM Capital, was quoted as saying by the Daily Telegraph.

The UK shareholders' association said it would not accept a solution which could allow an eventual buyer to profit.

An independent audit is set to determine the value of the shares and how much the government will pay shareholders.

Northern Rock has been put on the government's books, classified as around 90 billion pounds of public debt, and the focus will now shift to how soon a buyer or buyers can be found for its assets.

Analysts say that could be easier if lending slows over the coming years, shrinking the mortgage book as many of its customers remortgage with other banks, and as the funding model becomes driven by retail deposits not capital markets.

Alistair Darling, the UK finance minister, said he would welcome approaches. "At the moment because of the state of the financial markets it is not an ideal time to try and deal with a bank in the situation Northern Rock finds itself in, but of course I very much hope that over the coming period people will look at it," he told the BBC.

Opposition politicians ultimately blame Brown for the crisis, pointing to the regulatory framework he put in place a decade ago when he was finance minister under Tony Blair.

While the government has criticized Northern Rock's business model, Brown blames the bank's woes on a credit crisis that started with risky mortgage lending in the United States and has since spread throughout the world's banking system.

He argues the British economy is better placed than many to withstand the fallout from global financial market turmoil and the government said on Sunday nationalization was only temporary and in the best interest of taxpayers.

Agencies

(China Daily 02/19/2008 page17)