Energy industry an economic pillar in Iran

Today, Iran is located at the heart of the world energy resources and reserves in the Caspian Sea and the Persian Gulf.

|

Bandar Abbass Refinery |

Due to its huge energy resources, Iran ranks second among oil and gas producing nations in the world.

According to latest estimates, Iran has 136 billion barrels of proven oil reserves, or roughly 10 percent of the world's total proven oil reserves as of January 1, 2007. Iran has 40 productive fields, 27 onshore and 13 offshore, with the majority of crude oil reserves located in the southwestern part of the country.

In recent years, NIOC (National Iranian Oil Co) has been very successful in its exploration activities. As a result of its exploratory operations, it has discovered some very large oil and gas fields in the country.

Iran's reserves of gas, recognized as the fuel of the 21st century, are more than 16.13 percent of world reserves, and will last 200 years. Iran has an estimated 27.05 trillion cubic feet in proven natural gas reserves and has the world's second largest reserves after Russia. Around 62 percent of Iranian natural gas reserves have not yet been developed. Iran has also reached agreements with foreign partners to develop gas fields for liquefied natural gas (LNG) exports.

Another important project is the $7.4 billion Iran-Pakistan- India gas pipeline, which will transport Iranian natural gas to the Asian subcontinent.

Iran is expected to reach peak LNG exports of around 1462 billion cubic feet in the near future.

One of the most significant energy development projects in Iran is the offshore South Pars field, which is estimated to have 47 percent of Iran's total natural gas reserves. Discovered in 1990, and located 100 km offshore in the Persian Gulf, South Pars has a 25-phase development scheme spanning 20 years. The Iranian government expects each phase to yield 1 billion cubic feet and is developing the South Pars field primarily to meet its domestic market demand. The first 10 phases have been completed. Iran plans for the first 16 phases to be online by 2010.

Considering that Iran covers a major part of the oil and gas needs of Asian countries, and also the fact that it has huge oil and gas reserves as well as a unique geographical position, the country has the potential and actual capability to be the regional energy hub to transfer oil and gas to the neighboring countries. It is also the cheapest and shortest route to transfer the oil and gas resources of the region to international markets.

Storage projects

To overcome seasonal fluctuations in consumption, installation of underground gas storage has been recognized as the best mode of operation. Three underground storage projects are being evaluated, with some degree of progress, to ensure natural gas supply to internal users and export destinations.

National Iranian Gas Co (NIGC) has also identified several reservoirs that might be converted for underground gas storage. NIGC believes that by working over old wells and drilling new ones it can deplete the reservoir in two years and convert the Yortsha Dome saltwater reservoir to the Sarajeh gas and condensate field. Another saltwater reservoir being studied for use as gas storage is the Talkheh Dome in central Iran, which also contains negligible amounts of light and heavy hydrocarbons.

Other areas that NIGC thinks might have reservoirs amenable to gas storage are in the provinces of Abardejno, Siahkooh, Marehtapeh, Prandak and East Azerbaijan.

Expansion of Iran's gas industry follows a strategy in place since the early 1990s to replace oil with gas in domestic consumption. Gas now claims 70 percent and oil 30 percent of Iran's overall primary energy use.

Export markets

The strategic role of the Persian Gulf and the huge gas reserves in this area have provided a good opportunity for Iran to export gas through pipelines or in the form of LNG. NIGC believes pipeline exports can reach 44 billion cubic meters (bcm) in 2009 and 110 bcm by 2020. Besides Turkey, potential customers for Iranian gas include Ukraine, European Union, India, Pakistan, Armenia, Azerbaijan, Georgia and China. NIGC is targeting LNG exports from three planned liquefaction projects to China, Thailand and India to the tune of 35 million cubic meters (mcm) a day in 2009 and 180 mcm/day in 2020. Assalouyeh and Kish Island have been named as possible LNG export terminals.

Oman and Iran have signed an agreement to develop offshore gas fields in Iran and take the gas to Oman. The gas from the joint Bukha-Hengam and other fields would be converted into LNG at Oman's Qalhat LNG plant and marketed as exports by a joint company. The agreement also calls for joint petrochemical projects.

Bahrain has started discussions with Iran over importing natural gas through a new pipeline by 2015. As part of its plans to meet the kingdom's future electric power needs, Bahrain has implemented a twin-pronged strategy to boost gas supply. This involves both increasing domestic output and negotiating import agreements with its gas-rich neighbors.

The project for transferring gas to Europe is also economically attractive and will benefit all parties involved. Turkey and Ukraine have been considered as alternative routes, but the former is less expensive. In 2007, Iran signed agreements with Austria and Switzerland for the export of LNG worth about $30 billion.

Since the discovery of natural gas reserves in Iran's South Pars fields, the Iranian government has increased efforts to promote higher gas exports abroad.

The prospects for profit are especially good in south Asian countries like India and Pakistan. Pakistan and Iran signed a preliminary agreement for the construction of a natural gas pipeline linking the Iranian South Pars natural gas field in the Persian Gulf with Karachi. Iran later proposed an extension of the pipeline from Pakistan into India.

Import markets

Armenia and Iran have agreed to a long-term deal under which Iran will supply natural gas to Armenia over 20 years (starting in 2007) in exchange for electricity supplies from Armenia. The two countries will also build an 85-mile gas pipeline at a cost of more than $200 million (construction on the pipeline began in late November 2004).

|

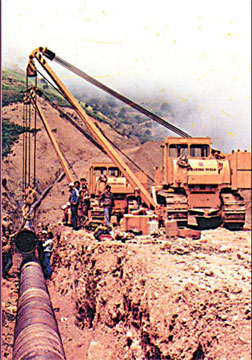

Workers lay gas pipeline in Astara-Ardabil. |

Iran's gas industry now contributes the lion's share to the country's fossil fuel basket and has entered an intense stage of development.

For more than 40 years, gas has played a secondary role to oil. But the growing demand for natural gas in the residential and industrial sectors, along with surging export demand, has launched a new era. To respond adequately, Iran's gas sector needs investments, especially in upstream development, technology transfer, and export and import facilitation. With or without foreign investment, Iran will be a key gas exporter for decades to come.

As global energy demand rises, natural gas increasingly plays a strategic role. The sector is poised for tremendous growth over the next two decades and some believe that it may overtake oil as the prime fuel between 2020 and 2030. Iran's huge proven reserves - some 28 trillion cubic meters - should make it a key player in the emerging global gas business.

These impressive reserve figures - second only to Russia's - underscore Iran's enormous potential. The National Iranian Gas Company plans the steady expansion of transmission and processing infrastructure in a program aimed at increasing the import and export of natural gas, which will take natural gas to parts of Iran not yet reached by distribution systems and boost exports by pipeline and in the form of LNG.

More than 60 percent of Iran's gas reserves are located in non-associated undeveloped or partially developed fields. The major non-associated gas fields include South Pars, North Pars, Kangan, Nar, and Khangiran. There are also several other large gas fields. However, most of the gas will come from the offshore South Pars gas field, which is being developed in stages. Supplementing that supply will be imports from Turkmenistan and, soon, from Azerbaijan.

South Pars was first identified in 1988. By 2010, more than 500,000 barrels per day of condensates could be produced at South Pars, mainly for domestic consumption. So far only 18 of its designed 28 phases have been activated. Besides condensate production and enhanced oil recovery, South Pars natural gas is intended for both domestic consumption and export. South Pars can produce more than 400 million cubic meters per day. Considering internal demand, half of this production can be assigned to exports.

Internal consumption represents a rapidly growing demand on Iranian gas supply. NIGC expects internal consumption to rise to 156.2 bcm per year in 2009.

Market expansion

By 2009, NIGC expects to have 29,400 km of gas transmission pipelines in place and a distribution network of 125,000 km. Domestic gas consumption that year will represent 69 percent of the Iranian energy market, and 54 million Iranians will have access to natural gas - about 80 percent of the population.

NIGC plans to invest about $18 billion through 2009 in high-pressure gas pipelines, compressor stations, gas-processing plants, underground storage, distribution networks, and maintenance.

Pipeline projects

Many of the pipeline projects planned by NIGC will be attached to the Iranian Gas Transmission (IGAT) system. Transmission pipelines having a length of 20,000 km take gas from various sources to destinations across the country. Lines with diameters of 56, 48, and 42 inches have been employed to carry more than 500 million cubic meters of natural gas per day.

The IGAT IV pipeline will carry 110 mcm/day of gas from South Pars and the Parsian gas plants to consumption areas. The project includes 1,030 km of 56-inch pipe in two sections and two compressor stations.

A second stage of IGAT IV will include a 42-inch spur line to Kerman, a 24-inch line to serve a Fars petrochemical plant, a second 40-inch line to Yazd, and a 40-inch Isfahan-Mobarakeh pipeline.

The 56-inch IGAT V trunkline will carry 75 mcm/day of sour gas from South Pars Phases 6-8 to Khoozestan oil fields for injection. It will connect Assaluye and Agha Jari, a distance of 504 km, and will have five compressor stations.

The IGAT VI pipeline will generally parallel IGAT V to serve the gas needs of Bushehr and Khoozestan provinces, including oil field injection. With a length of 492 km and a diameter of 56 inches, it will have a capacity of 90 mcm/day.

IGAT VII, a 42 to 56-inch line running for 860 km, will carry gas produced in South Pars Phases 9 and 10 for use in Sistan and Baluchestan provinces in southern Iran, and possibly for export to the UAE, Pakistan and India.

IGAT VIII, a 1,050-km, 56-inch line, will carry South Pars gas to the Parsian gas plant and north to a line serving Tehran. It will have 10 compressor stations.

Gas processing projects

Seven gas processing plants have recently been completed or are planned and under construction in Iran. The Parsian plant began treatment operations in 2003, dehydrating 20 mcm/day of gas from Tabnak field.

Construction of the new processing facilities will proceed in two phases, one with an inlet capacity of 48 mcm/day and the other 28 mcm/day. The complex is designed for annual yields of 85,000 tons of ethane, 11 million barrels of pentanes-plus, 310,000 tons of butane and 450,000 tons of propane.

The Bidboland II plant will sweeten and process 57 mcm/day of gas at facilities that will be built about 14 km southeast of the existing Bidboland plant. Fed by gas from the Pazanan, Gachsaran, and Bibi Hakimeh fields, the new plant has design output capacities of 15 bcm of sweet gas, 1.48 million tons of ethane, 1.51 million tons of propane and butane, and 860,000 tons of natural gasoline.

About 6 bcm per year from the plant have been targeted for oil-field injection, the rest for delivery into the gas grid. Ethane will go to a petrochemical plant at Arvand. The other products will be exported through Bandar Mahshahr.

In a separate project, NIGC plans a gas processing plant 25 km northwest of the city of Ilam and 12 km west of Chavar in western Iran. The Ilam plant will process gas from the Tange Bijar and Kamankooh fields. Built in two phases, it will have an inlet capacity of 10 mcm/day and will supply dry gas to cities in Ilam Province and liquids to a petrochemical plant at Ilam.

NIGC also plans a small processing plant at Masjed Soleiman with inlet capacity of 1 mcm/day and is studying a plant able to process 14 mcm/day at South Gesho sour gas field in Hormuzgan Province. The South Gesho facility, near an existing plant at Sarkhon, would have two trains with identical inlet capacities. After removal of 600 tons/day of sulfur, sweet gas would move to markets in the southeastern part of the country, including some to a power plant at Bandar Abbas.

Gas fields

An estimated over $16 billion is needed to develop all the upstream and downstream gas fields.

According to a contract signed between NIOC and a Chinese company, North Pars Gas Field will be developed in four different phases, the final product of which will be LNG. Half of the produced gas will be taken by Iran and the rest by the Chinese contractor.

A contract to develop the gas fields of Golshan and Ferdows has been inked between NIOC and SKS Ventures of Malaysia. The gas fields are expected to produce 20 trillion tons of LNG per year.

The development project of upstream gas fields in the form of buyback deals will be implemented by the NIOC. The downstream gas fields, which have 25-year development contracts, will likewise be executed by the NIOC. All investments will be procured from the Malaysian company.

The investment capital for upstream projects in North Pars is $5 billion, while for downstream projects the figure is from $10-11 billion and for the transportation sector around $5 billion.

The South Pars/North Dome Gas field located in the Persian Gulf is the world's biggest gas field and is shared by Iran and Qatar. It was discovered in 1990 by NIOC.

Reserves there have been estimated variously at 53.8 billion cubic meters gas in place and 56 billion barrels of condensate.

The field consists of two independent gas-bearing configurations, Kangan and Upper Dalan. Each structure is divided into two different reservoir layers separated by impermeable barriers. The field thus consists of four independent reservoir layers K1, K2, K3 and K4.

The estimates for the Iranian section are 14 tcm of gas in place and around 9.2 tcm of recoverable gas.

Gas production started from South Pars field by commissioning development phase 2 in December 2002 to produce liquid gas.

Gas from this field is conveyed to shore via pipeline and is processed at Assaluyeh.

Development projects phases 1 and 2 have been inked among NIOC, Shell and Rapsol.

Liquid gas produced will be sent to the Persian LNG factory for further processing before it turns into LNG.

Completion of the development project will make Iran the owner of the biggest LNG factory in the world with a capacity to produce 16.2 million tons of LNG per annum.

The estimated initial investment to develop these fields is around $4.3 billion, with $5.5-$6 billion for upstream and downstream sectors as well as the LNG unit respectively.

Oil industry

Azadegan is Iran's biggest oilfield with in place reserves of 26 billion barrels.

The field is considered an entity that provides more than economic gains, and an opportunity for development of international cooperation at a more extended level.

It opens new horizons toward the realization of the ideals involved and paves the way for global development while providing a worthy site of subsistence for present and future global inhabitants.

Last year, the country also signed several contracts to build new oil refineries across the nation. Some of these projects include improving the quality of oil products as well as boosting production capacity of Shazand Oil Refinery in Arak.

The article is provided by the Iranian Embassy in China

|

|

(China Daily 02/18/2008 page14)