Copper rises but weather may dampen sentiment

Shanghai copper rose 1.5 percent yesterday on expectations of rising copper consumption after the Chinese Lunar New Year holidays and on stock market optimism driven by takeover news.

However, continued heavy ice and snow across central and southern China could dampen market sentiment and hamper gains in the metal, analysts said.

The April copper contract, the most active on the Shanghai Futures Exchange, rose 890 yuan, to 62,100 yuan a ton by the daily close.

"Investors are looking forward to a warmer physical copper market after the Lunar New Year holidays, supported by larger consumption by Chinese fabricators," said analyst Wang Zheng at Fubao Metals.

Some copper fabricators in eastern China provinces have moved forward their shutdown schedules partly due to the power shortages, but they are expected to pick up production after the holidays with an improvement in electricity supply.

"The weather directs market sentiment, and not only in the metals market," Wang said.

Severe weather has hit China's electricity grid, forcing hundreds of smelters to stop their facilities. The production cut has helped aluminum and zinc prices in Shanghai to touch 20,000 yuan.

Shanghai's April aluminum ended up 20 yuan at 19,560 yuan.

Antaike, a government-backed consultancy, estimated that as much as 1.32 million tons of primary aluminum capacity has been impacted by the bad weather. The firm expected that China could lose 330,000 tons of output during the shut downs.

Shanghai's most-traded April zinc futures contract rose 3.8 percent to 21,265 yuan a ton. The contract has gained over 13 percent since last week on supply concerns after the closure of major smelters in China.

Three-month LME zinc was up $25 at $2,500.

Copper for delivery in three months on the London Metal Exchange gained $65 to $7,315 per ton, after falling $100 on Friday.

In a note, MF Global analyst Edward Meir said: "It seems that for the moment, the near-recessionary conditions in the US seem to have taken a back seat to the supply and production disruptions we are seeing out of China and the weaker dollar."

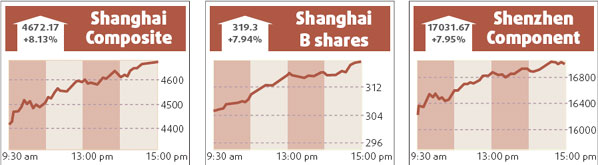

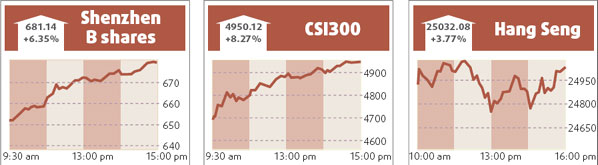

Meir said stock markets, which seem to be on the boil on merger news, could keep metals firm.

MSCI's measure of Asian stocks excluding Japan rose 2.4 percent, while Hong Kong's Hang Seng was up 3 percent.

Agencies

(China Daily 02/05/2008 page15)