Index has second biggest monthly fall in 10 years

The Shanghai stock market fell yesterday and the main index posted a loss of 16.7 percent for January, its second largest monthly drop this decade, because of turmoil in global markets and fears of an economic slowdown.

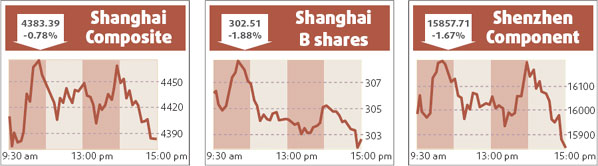

The Shanghai Composite Index ended the day down 0.78 percent at a five-month closing low of 4383.393 points, leaving it 28 percent below October's record high. The decade's biggest monthly fall was an 18.2 percent slide in November last year.

Turnover in Shanghai A shares shrank to a five-week low of 75.9 billion yuan from Wednesday's 92.2 billion.

"Investors simply don't dare to trade," said Zheng Weigang, senior stock analyst at Shanghai Securities.

"Sour sentiment is exaggerating every negative factor - global markets are weak, and fears over the impact of the US slowdown on China are rising.

"Above all, the government hasn't given any sign that it wants to support the market during its slide."

Authorities have in fact resumed approvals of equity funds in recent days, apparently to cushion the market. Industrial and Commercial Bank of China said yesterday it would launch a wealth management product on Feb 1 to invest in local mutual funds and stocks, aiming to raise 10 billion yuan.

PetroChina, the biggest stock in the index, surged 3.35 percent to 25.27 yuan, though it closed well off its intra-day high of 25.87 yuan. Traders said they were puzzled by the rise, which occurred despite a drop in PetroChina's Hong Kong-listed H shares.

Many said they believed institutional investors might be deliberately pushing PetroChina up to support the main index and prevent battered investor sentiment from collapsing, while taking the opportunity to sell other stocks.

HK blue chips slide

Hong Kong blue chips slid for a second straight day yesterday as investors reduced their holdings, unnerved by more bad news ranging from China's ongoing weather problems to possible credit downgrades of top US bond insurers.

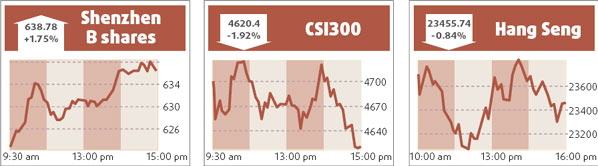

The market finished January down 15.7 percent, its worst monthly performance since October 1997 amid growing risks of a US recession.

The benchmark Hang Seng Index ended down 0.8 percent at 23455.74.

The China Enterprises index of H shares, or Hong Kong-listed shares in mainland companies, fell 2.1 percent to 12485.07.

Agencies

(China Daily 02/01/2008 page15)