Shanghai stocks stable with liquidity hope

Shanghai stocks stabilized yesterday after Monday's sharp plunge as investors took note of the latest government measures that could boost market liquidity.

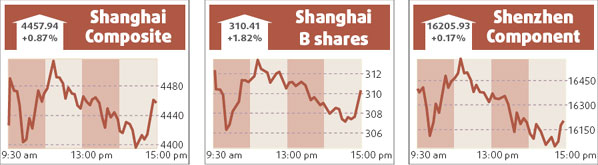

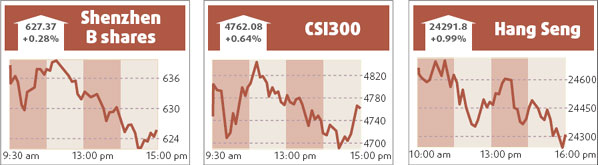

The benchmark Shanghai Composite Index edged up 0.87 percent, or 38.6 points, to close at 4457.9 points yesterday, when the securities watchdog issued a draft of detailed regulations in which securities firms are allowed to provide asset management services.

The Shenzhen Component Index climbed 0.17 percent to close at 16205.9 points. Turnover on the two bourses fell 27 percent from Monday to 121.14 billion yuan.

The CSI 300 Index, which tracks yuan-denominated A shares listed on China's two exchanges, rose by 30.2 points, or 0.6 percent, to 4762.08 at the close. It had slumped 6.8 percent on Monday to close at its lowest since Nov 28.

"The government's policy has had a positive impact on investors and shows the leadership's attention to the stock market drop," said Wu Feng, an analyst at TX Investment Consulting Co Ltd.

After a three-year suspension, the China Securities Regulatory Commission on Monday released a draft version of the detailed regulation to allow securities firms to tap into the customer asset management business, with a threshold of 1 million yuan.

There is a correction demand in the short term, Wu said. "Financial and property stocks grew faster than the entire market, the yuan keeps appreciating, and CPI growth is outpacing the interest rate. These are all positive factors in the stock market."

PetroChina, the largest mainland-listed company, has stopped dragging down the market as it seems to have stabilized around 25 yuan per share, a drop from 48 yuan on its first trading day, Wu said. It edged up 0.75 percent to close at 24.2 yuan yesterday.

But other analysts said the stock would swing in a narrow band between 4200 and 4600 points, and major corrections are not foreseen in the near future.

"We don't foresee a major plunge until the Chinese New Year that begins on Feb 6," said Zhu Haibin, an analyst at Essence Securities Co. "But any release of macroeconomic data would have a big impact on market confidence."

Other markets in Asia also rebounded after the major fall on Monday.

The MSCI Asia Pacific Index added 1.4 percent yesterday.

(China Daily 01/30/2008 page15)