Bankers discuss economic woes

|

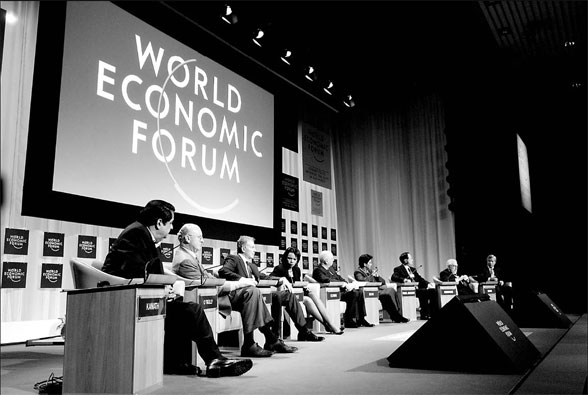

A panel including Tony Blair (third left), former UK prime minister, Condoleezza Rice (fourth left), US secretary of state, and Henry Kissinger (second right), former US secretary of state, at the World Economic Forum in Davos, Switzerland. Bloomberg News |

Bankers meeting at the Swiss ski resort of Davos said there are increasing risks of a global recession, while manufacturers countered that they have yet to feel it in their business.

Financiers tramped through the snow, glued to their Blackberries, as news broke of an emergency interest-rate cut by the Federal Reserve and Societe Generale SA's record loss at the hands of a rogue trader. Industrialists took comfort from the prospect of further rate cuts, demand from oil producers and the likelihood of continued - albeit slower - growth in China.

"There's a split between those who are in finance and those who are in more general industries," Daniel Yergin, chairman of Massachusetts-based Cambridge Energy Research Associates Inc, said in an interview. "The buildup of these very large financial surpluses in the energy exporters and the Asian manufacturing exporters has coincided with this crisis."

Predictions of a US recession, and whether the rest of the world will follow, was the main debate as 2,500 executives, officials and investors gathered 1,560 meters above sea level for the World Economic Forum's annual meeting.

Economists at Goldman Sachs Group Inc, Morgan Stanley and Merrill Lynch & Co project the United States will this year suffer its first recession since 2001. Michael Dell, chief executive officer of Dell Inc, the world's second-largest maker of personal computers, said there's no reason "to get in a panic."

"There is some economic downturn, but I would not move to put it in the recession category," Alan Boeckmann, CEO of Irving, Texas-based Fluor Corp, said. The Middle East is providing more oil and gas contracts, and mining projects are strong in Asia and South America, he said.

Even if the US does sneeze, "that doesn't mean the whole world will catch a cold", Juergen Hambrecht, CEO of BASF AG, the world's largest chemical maker, said.

While the global economy will certainly slow, a world recession isn't inevitable, says Allen Sinai, chief economist at Decision Economics in New York. Sinai puts the odds at 20 percent. Nariman Behravesh, chief economist at Global Insight in Lexington, Massachusetts, estimates a 30 percent chance.

Caterpillar Inc reported last week that fourth-quarter earnings rose 11 percent as demand in emerging markets offset slower US sales. "Compared to the audience here I'm on the optimistic side," James Owens, CEO of the world's largest maker of earth-moving equipment, said in Davos. The likelihood the US dollar, interest rates and taxes will fall further should provide more relief, he said.

The worst US housing market in 26 years has eroded growth in the world's largest economy, pushed up global borrowing costs and triggered historic losses and executive ousters at banks and brokers including New York-based Merrill and Citigroup Inc. Financial companies eliminated more than 25,000 jobs in the past six months as they racked up $136 billion of writedowns and credit losses tied to mortgage securities.

Such carnage explains why Wall Street executives spent their time on the mountainside predicting a greater US slowdown and warning that economies elsewhere won't be immune.

"The problems in the credit market are spreading, they are spreading to the consumer sector," John Thain, Merrill's chief executive officer, told a panel. "We are likely to see another wave of problems on the consumer-credit side."

Agencies

(China Daily 01/29/2008 page16)