Shanghai airlines forecast mixed results

Two major Shanghai-based airlines released 2007 earnings previews yesterday, with China Eastern expecting a turnaround while Shanghai Airlines predicted a loss.

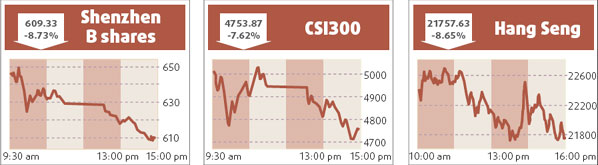

A shares in China Eastern and Shanghai Airlines plunged to daily limits in yesterday's trading.

China Eastern said yesterday a big increase in foreign exchange income had helped it turn a profit in 2007, in contrast to a loss of 2 billion yuan in 2006. The company didn't provide figures for last year.

Separately, Shanghai Airlines attributed its expected loss for last year to soaring fuel costs. Some new routes are still in the initial investment period before they generate profit, the company said in a statement to the Shanghai Stock Exchange.

Analysts said rising fuel oil prices have put pressure on airlines.

Fuel oil provider China Aviation Oil Holding Co reported that it raised the fuel oil price by 210 yuan per ton in the first quarter this year, in response to the soaring international oil price.

In November last year, the National Development and Reform Commission (NDRC) raised the price of kerosene for airlines by 500 yuan per ton.

"The airlines can transfer the rising cost to consumers by lifting prices, as aviation market demand still remains huge," said Zhuo Yue, an analyst at GF Securities, adding that the government is expected to raise the fuel-added fee soon.

In November last year, the NDRC raised the fuel-added fee by 10 yuan for routes under 800 km and by 20 yuan for those over 800 km.

"China Eastern has big earnings from exchange income, which largely offset the rising cost," said Zheng Qingping, an analyst at Tebon Securities.

"The total assets of Shanghai Airlines are much smaller than China Eastern's, so it is more vulnerable to price changes," Zheng said. China Eastern had total assets of 67.1 billion yuan by the end of September, while Shanghai Airlines had 13.1 billion yuan in total assets.

Meanwhile, Shanghai Airlines Cargo Intl Co Ltd, which is 55 percent-owned by Shanghai Airlines, was still in the initial investment stage, after it began operation in July 2006. "It also contributed to Shanghai Airlines' loss," said Zheng. Shanghai Airlines Cargo posted a loss of around 70 million yuan in the first half of 2007.

Zhuo said the booming aviation market would continue in 2008, with the expectation of currency appreciation and the industry integration.

(China Daily 01/23/2008 page15)