Famous sons launch bid to buy out media firm

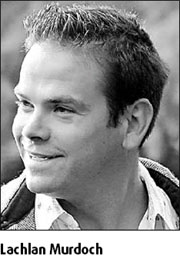

Lachlan Murdoch, son of media tycoon Rupert Murdoch, and Australian gaming magnate James Packer launched a  joint A$3.3 billion ($2.9 billion) offer yesterday to buy out the Packer-backed publishing company Consolidated Media Holdings.

joint A$3.3 billion ($2.9 billion) offer yesterday to buy out the Packer-backed publishing company Consolidated Media Holdings.

The deal would mark Lachlan's first big business move since quitting his father's business in 2005, and is the second major effort by the two rival media empires to forge a venture, after backing One.Tel, a telecommunications company that collapsed in 2001 owing A$600 million.

The move comes less than three months since Packer separated his late father Kerry Packer's media business from gaming to better focus on building up the gambling operations.

The sons of the media moguls are each expected to take a 50 percent stake in the joint venture vehicle Consolidated Media, which was formed from the split late last year.

The indicative offer, which represents a 24.4 percent premium to Consolidated's last traded price, has the blessing of Consolidated's biggest shareholder - the James Packer-backed Consolidated Press Holdings. Consolidated Media Holdings has appointed UBS as its financial advisor.

Consolidated Media owns 25 percent of pay-TV provider Foxtel, about 27 percent of online job site Seek Ltd and 25 percent of PBL Media. Seek rose 7.4 percent to A$7.15 yesterday.

"The assets in the business are quite attractive. They supply content to pay-TV and that is where the growth is in the media industry in the foreseeable future in this country," Matt Williams, portfolio manager with Perpetual Ltd, said before the official statement was released. He said there was a possibility of a rival bidder emerging.

Agencies

(China Daily 01/22/2008 page17)