Oracle wins the day in bitter battle for BEA

|

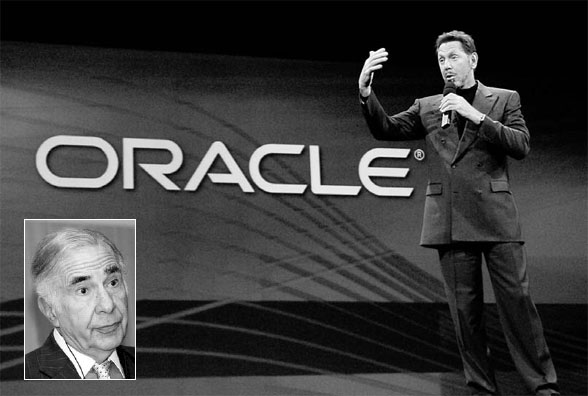

Oracle Corp CEO Larry Ellison speaks at the Oracle OpenWorld conference. Inset: Billionaire investor Carl Icahn. Bloomberg News |

Oracle Corp, the world's third-largest software maker, won a three-month-long campaign to buy BEA Systems Inc by raising its bid for the company by 14 percent to $8.5 billion.

Icahn and BEA's board initially rejected Oracle, saying it undervalued the company, but no other buyers emerged even as BEA's investment bank, Goldman Sachs, solicited bids from other software makers.

BEA's largest shareholder, activist investor Carl Icahn, said he helped broker the deal over the weekend, bringing the two sides together in a bid to resolve one of last year's highest-profile corporate takeover battles. The companies announced on Wednesday that they have reached a deal.

"The two sides were not talking to each other. They were like oil and water," said Icahn, who owns nearly 13 percent of BEA. "I was very instrumental."

The billionaire investor said the key negotiations occurred on Sunday afternoon and continued overnight, adding that much progress was made during half-time of the playoff football game between the New York Giants and Dallas Cowboys.

The price that BEA finally agreed to, $19.375 per share in cash, is a compromise between the $17 that Oracle offered in October and the $21 that BEA had demanded.

"It's a fair price," said Trip Chowdhry, analyst at Global Equities Research.

Shares of BEA rose 18.8 percent to $18.51 on the NASDAQ, while Oracle shares rose 2.72 percent to $21.89.

BEA makes "middleware," which helps business computer systems interact with each other, allowing companies to integrate computer systems running on software that was not originally developed to communicate with each other.

Oracle already sells similar products, but analysts say BEA's Weblogic and IBM's WebSphere application servers are generally considered to be the standards among this type of integration software.

"BEA sells some great glue, and everyone needs glue," said Eric Johnson, director of the Center for Digital Strategies at the Tuck School of Business at Dartmouth.

Oracle said the deal, valued at $7.2 billion net of cash on hand of $1.3 billion, would increase its adjusted earnings per share by at least 1 cent to 2 cents in the first full year after closing, which is expected in mid-2008.

Analysts said the acquisition could also give Oracle an edge in sales of business-management software, a market in which Oracle is the second-largest player after SAP.

BEA's brand name and expertise in integration software could help Oracle win business over SAP, said Nucleus Research analyst David O'Connell.

"This brings Oracle's integration expertise up a couple of competitive notches," he said.

"SAP is notorious for lengthy and unpredictable deployments. The better you can integrate, the better you can deploy."

Icahn started accumulating shares in BEA in August, when the stock traded as low as $11.02.

He called on the board to put BEA up for sale, saying a bigger technology company would be able to boost revenue and profit.

Icahn had said that BEA was not worth as much to shareholders as a stand-alone entity as it would be to shareholders of a potential acquirer.

Jefferies & Co analyst Katherine Egbert said Icahn's argument particularly rings true given signs the United States may be heading into a recession.

"In a recession, it is harder for smaller companies to compete," Egbert said.

Agencies

(China Daily 01/18/2008 page16)