Metals, agriculture drive up Shanghai stocks

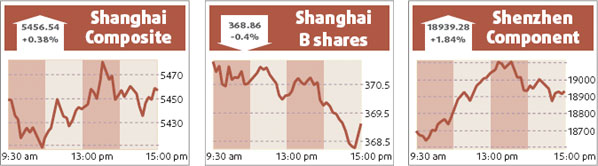

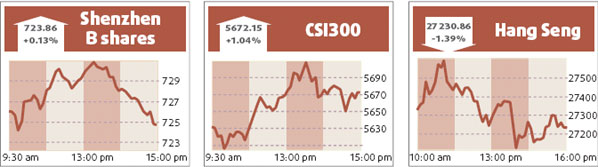

Shanghai key stock index rose 0.38 percent to a two-month closing high in heavy trade yesterday as expectations for high inflation pushed up metals, agriculture and other resource shares.

The Shanghai Composite Index ended at 5456.541 points. Turnover in Shanghai A shares was very active at 173.5 billion yuan, up from Wednesday's 138.8 billion yuan.

"Money has been chasing companies that are likely to benefit from price hikes, such as agriculture and food," said Gao Lingzhi, analyst at Great Wall Securities Co.

The cabinet said on Wednesday that China still faced fairly large inflationary pressure and Beijing would temporarily intervene in goods markets to brake rising prices for basic necessities, and block rises in domestic energy prices for now.

The announcement helped to drag down shares in Hong Kong, because of fears that corporate profits would be capped.

In the domestic stock market, however, investors interpreted the announcement mainly as a sign that inflation would remain high for a while.

Farm product producer Xinjiang Talimu Agriculture Development surged 4.73 percent to 13.52 yuan, while Guannong Fruit jumped 7.85 percent to 63.18 yuan. Sugar maker Guitang gained 7.27 percent to 14.45 yuan.

The inflation theme also helped to boost non-precious metals stocks, with Aluminium Corp of China (Chalco) surging 2.69 percent to 43.46 yuan.

Oil refiners slipped because curbs on domestic oil product prices could further hurt margins - Sinopec slid 2.79 percent to 23.70 yuan and PetroChina lost 0.84 percent to 30.56 yuan.

But the companies' A shares outperformed their H shares in Hong Kong, where Sinopec plunged more than 6 percent.

HK sheds 1.4%

The blue-chip Hang Seng Index closed down 384.99 points, or 1.4 percent, to end at 27230.86.

The China Enterprises index of H shares, or Hong Kong-listed shares in mainland companies, fell 0.7 percent, or 111.77 points, to 16027.69.

Hong Kong mainboard turnover was HK$123.3 billion compared to Wednesday's HK$120.3 billion.

The news of China's move to tamper with market prices dampened hopes for any near-term tariff increases by China's power producers. Huaneng Power sank nearly 5 percent to HK$7.78 and China Resources Power dived 8.3 percent to HK$23.70.

Agencies

(China Daily 01/11/2008 page15)