Shanghai outperforms sagging overseas markets

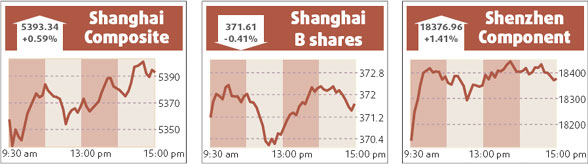

Shanghai shares rose yesterday, with the main index setting a fresh seven-week closing high in heavy trade, as the market continued to outperform tumbling foreign markets.

The Shanghai Composite Index ended up a provisional 0.59 percent at 5393.343 points. Turnover in Shanghai A shares rose to 161.4 billion yuan, not far from levels seen when the market was hitting its record high last October, against Friday's 144.7 billion yuan.

Despite tightening monetary policy and the tumult in overseas markets as Wall Street sags, many Chinese investors are counting on a rally in the first quarter of this year, after the index appeared to form a bottom at its November and December lows.

"China's stock market has its own logic," said Zhang Yang, strategist at Oriental Securities Co. "Market sentiment is still strong on the back of several major themes, such as rising consumption and a bull run in agricultural products."

He added: "Although prospects remain uncertain for the banking and property industries, a rebound in such stocks is justified as they're about to announce their 2007 earnings, and high growth is certain for the past year."

As the Hong Kong market sagged yesterday, the average premium of Shanghai-listed A shares above Hong Kong-listed H shares climbed to a four-month high of 93 percent, near August's intra-day record high of 98 percent.

This appeared to prompt profit-taking in some large dual-listed shares such as Industrial and Commercial Bank of China, down 0.62 percent to 7.97 yuan, and PetroChina, off 0.70 percent at 31.09 yuan.

Property stocks were strong with Vanke gaining 3.21 percent to 30.18 yuan, hitting a three-week high. After official lending curbs for last year forced banks to cut back on new loans in December, loans are resuming under the new year's quotas, which could help the property sector.

Blue chips fall

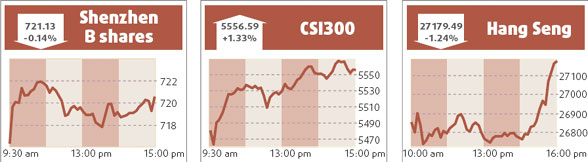

Hong Kong blue chips fell 1.3 percent yesterday amid fears that the US is heading for a recession after the country's jobless rate rose sharply, but stocks pared earlier losses as local real estate shares gained on expectations of more US rate cuts.

The benchmark Hang Seng Index ended at 27179.49.

The China Enterprises Index of H shares, or Hong Kong-listed shares in mainland companies, fell 2 percent to 15590.74.

HSBC Holdings Plc, which gets about a fifth of its earnings from North America, slid to a two-year low. Li & Fung Ltd, a supplier to Wal-Mart Stores Inc, posted its biggest tumble since May 2004.

Agencies

(China Daily 01/08/2008 page15)