Olympics-related shares push up Shanghai index

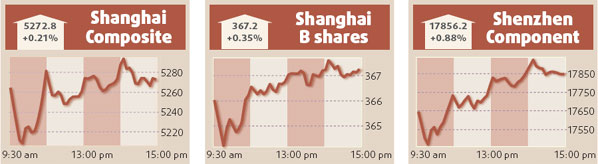

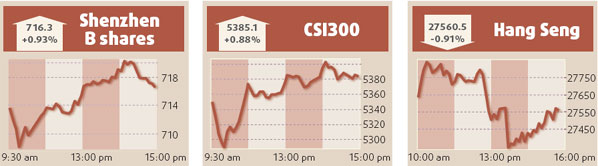

Olympics-concept stocks soared, pushing the Shanghai Composite Index up 0.21 percent yesterday when trading resumed after a four-day New Year break.

The benchmark indicator rose 11.25 points to close at 5272.81. The Shenzhen Component Index jumped 0.88 percent to close at 17856.15. The turnover on the two bourses amounted to 197.66 billion yuan, up 2.1 percent from Friday.

Meanwhile, the Hang Seng Index dropped 0.91 percent to close at 27560.52 yesterday.

Olympics-concept stocks are companies that investors expect to benefit from the Beijing 2008 Games, including those in the real estate, construction, infrastructure and energy sectors. Analysts said Olympics-concept companies are expected to become a major investment focus this year.

Prices of leading building materials manufacturer BNBM Public Ltd Co soared to its daily allowable limits to close at 13.6 yuan. Travel agency Beijing Tour and Beijing-based real estate developer North Star Co also surged 10 percent.

A report from China International Capital Corp Ltd said investment focus will vary from phase to phase of the Beijing Olympics.

Construction companies will benefit the most during the preparation phase of the Olympics. Consumption companies will benefit during the Olympics, while companies that can raise popularity through the event can ensure continuous growth after the Olympics, said the report.

In addition, expectations of good corporate earnings in 2007, which are scheduled to be released from mid January, the continuous currency appreciation, and no further tightening monetary policy during the New Year break have combined to boost investor confidence, analysts said.

"Investors' focus began to shift from large caps to small and medium-sized companies, but investors should be more cautious in stock trading in case of more price fluctuation," said Zhu Haibin, an analyst at Essence Securities.

Many mainland large caps fell in yesterday's trading, triggered by the weak performance of their counterparts in Hong Kong. PetroChina dropped 1.23 percent to close at 30.58 yuan while its H-share counterpart tumbled 2.16 percent.

"Large-scale conversion of non-tradable shares to tradable shares for large caps in the beginning of this year is expected to trigger stock market volatility," said Wu Feng, an analyst at TX Investment Consulting Co Ltd.

Around 47.2 billion yuan of non-tradable shares are expected to be converted to tradable shares this month, according to Southwest Securities.

(China Daily 01/03/2008 page15)