Biz People

Speculators 'control' prices

Oil prices, which have declined more than 10 percent from a record, are "controlled by speculators", OPEC Secretary General Abdalla el-Badri said.

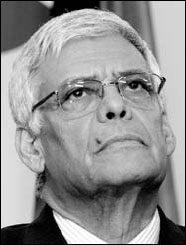

Current prices are "suitable", el-Badri (below right) said in Bali, Indonesia, where he is attending a United Nations climate change conference. The Organization of Petroleum Exporting Countries supplies more than 40 percent of the world's oil.

At its meeting in Abu Dhabi last Wednesday, OPEC decided to leave production targets unchanged after ministers from the 13-nation group said high prices weren't caused by a lack of crude oil supply. OPEC President Mohamed al-Hamli said then that speculation, refining bottlenecks and political events are partly to blame for high oil prices, not a lack of OPEC crude.

OPEC will assess the market in February before deciding on output policy, el-Badri said.

The benchmark New York crude oil contract rose as much as 55 cents, or 0.6 percent, to $88.41 a barrel in after-hours electronic trading on the New York Mercantile Exchange. Prices reached a record $99.29 reached on November 21.

Top investor backs EADS

Christian Cambier became France's best investor this year by buying losers. Now he's staking that reputation on European Aeronautic Defence & Space Co, one of the country's worst stocks.

EADS is at the center of France's largest insider-trading probe in two decades, while its Airbus SAS unit is struggling with a rising euro and delays in the A380 superjumbo jet program. The company, Cambier's largest holding, has fallen 18 percent this year in Paris and he is still investing.

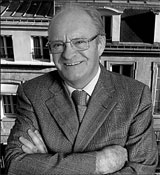

"When there's negative news, that's when I buy," Cambier (right), chief executive officer of Prigest SA, said in his Paris office. "No one wants the stocks."

Cambier's 333 million-euro Valfrance Fund has returned 14 percent this year, compared with a 6.1 percent gain for France's CAC 40 Index. It is the best performer of 98 French-registered equity funds with assets of more than 100 million euros, according to Morningstar Inc. The outperformance is attracting clients: the fund's size has more than doubled from 150 million euros a year ago.

Buying stocks others don't want has worked before. Cambier, 62, invested in France Telecom SA last year, when its fixed-line division was losing clients to competitors such as Iliad SA, which offered cheaper broadband Internet access.

The company, which fell 20 percent in the first half of 2006, is up 20 percent this year.

(China Daily 12/12/2007 page16)