Biz People

Moores to fund huge telescope

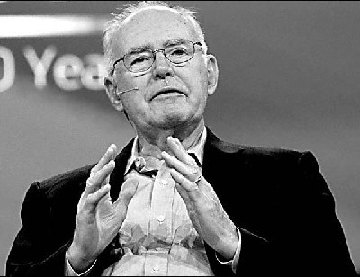

Intel Corp co-founder Gordon Moore (right) and his wife, Betty, will help build the world's largest telescope by giving $200 million to the California Institute of Technology and the University of California.

The couple's San Francisco-based foundation will add to a previous gift of $50 million, the University of California said in a statement. The new donation, to be paid over nine years, will help develop and build the Thirty-Meter Telescope, the school said.

The telescope project, whose cost may reach $1 billion, is a collaboration between Caltech in Pasadena; the University of California, Berkeley; and an association of Canadian scientists. Astronomers could use the telescope to locate and analyze light from the first star systems, study how the Milky Way and other galaxies were formed and evolved, and examine planet formation around stars, the statement said.

The schools "are thrilled with the foundation's confidence in the project, and we and our partners are eager to create a history-making tool that will allow us to see farther into the universe than ever before", Caltech President Jean-Lou Chameau said in the statement.

Clinton hits out at Wall Street

US presidential hopeful Hillary Clinton (right) has called on Wall Street to accept some responsibility for the home foreclosure crisis, saying the financial sector gave mortgages to people who were unlikely to be able to make repayments.

"I believe Wall Street shifted risk away from people who knew what was going on, onto people who did not," the New York senator told a gathering of business leaders at the NASDAQ Marketsite in Times Square.

The Democratic presidential candidate proposed several steps to forestall mortgage foreclosures, including a 90-day moratorium on further loan foreclosures on owner-occupied homes and a freeze that would keep subprime mortgage rates from rising for at least five years.

Couple jailed for insider trading

An Ex-Morgan Stanley vice-president and her husband, a former ING Investment Management analyst, were sentenced to 18 months in prison as a judge assailed the "pure greed" that drove them to trade on secret stock tips.

US District Judge Colleen McMahon in New York on Wednesday turned aside a request by Jennifer Wang, of Englishtown, New Jersey, that she get probation so that she may care for her infant son.

Wang and her husband, Ruben Chen, faced as long as 37 months in prison after admitting in September that they made $611,000 through three trades based on inside information.

Wang and Chen were arrested in May for trading in the securities of Town and Country Trust, Glenborough Realty Trust and Genesis Health Care based on information Wang learned from New York-based Morgan Stanley.

They made their illegal trades from December 2005 to March 2007.

(China Daily 12/07/2007 page16)