Are humans' days numbered at NYSE?

The computer age has wiped out the need for human traders in many stock markets around the world, but the New York Stock Exchange is fighting to ensure the survival of its historic trading floor.

At 11 Wall Street behind the NYSE's imposing white marble facade, about 1,500 dealers continue to buy and sell shares on the exchange's trading floor.

"That's good for the visibility. It's a symbol," said Patrick Healy, who heads The Issuer Advisory Group which advises companies on stock trading related matters.

Although traders on the New York Mercantile Exchange (Nymex) are known for feverishly calling out their trades and using mysterious hand signals to conduct business, such rowdiness has largely been replaced at the NYSE by computers.

The remaining NYSE traders who ply their business in the cavernous trading hall typically work around trading booths adorned with their companies' names, but their ranks have been significantly depleted.

Many markets around the world are all-electronic. Traders on the Paris Bourse for example hung up their jackets about 20 years ago.

Popular backdrop

|

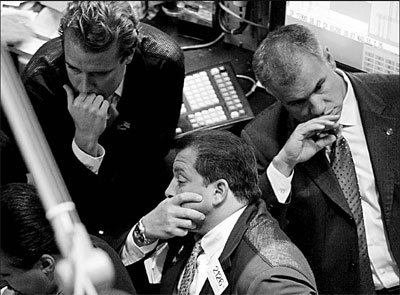

Traders consider the activity in the market at the New York Stock Exchange. Peter Foley/Bloomberg News |

Although the number of NYSE traders has sharply fallen in recent years, the floor is a popular backdrop for television correspondents covering the stock markets.

"Obviously there are much fewer people here than there were before. We do use more technology," said Doreen Mogavero of Mogavero Lee & Co, who has worked as an NYSE trader since 1980.

The exchange has dramatically cut back its trading space in the past seven years and trading now only occurs in the main trading chamber and another room after several other trading rooms were shuttered.

The speed of computer trading, which made trading cheaper and also meant that traders did not have to be located physically at the exchange, rendered the vast trading spaces obsolete.

'Specialists'

So-called "specialists" still work on the floor, however. They act as counterparties between two parties wanting to trade shares, but even their ranks are shrinking.

Van der Moolen and Susquehana, two specialist trading firms of the seven still based on the floor, announced last month that they were quitting the exchange which hosted around 40 such firms in the 1990s.

Some 85 percent of the billions of share trades handled by the exchange every day are now conducted electronically as powerful computers can handle much more volume than stressed humans.

"The floor as we knew it is dead," said James Angel, a finance professor at Georgetown University.

Angel said there is less and less demand for human traders, but he said the floor provides a good media backdrop where share trading and business can be discussed for the television cameras.

'Best of both worlds'

Mogavero said she has the best of both worlds as she can trade electronically, but also stroll over to another trading position and talk face-to-face with another dealer if needed.

The NYSE's new chief executive officer, Duncan Niederauer, has pledged to keep the famous floor open for business.

"The floor will continue to be an element of our model," he said recently, adding "we are in a unique position that we think we can take advantage of".

Niederauer's predecessor, John Thain who left the exchange this month to become the CEO of Merrill Lynch, accelerated the NYSE's move to electronic trading as well as overseeing its merger with European stock market operator, Euronext.

Niederauer appears to be keen to take up where Thain left off in terms of modernizing the exchange's technological advances.

Healy warned that the coming year could be tough for the remaining floor traders.

"2008 is going to be a very tough year because the economics on the floor are not allowing the people to make any money and if they don't make any money, they will continue to leave," he said.

AFP

(China Daily 12/04/2007 page16)