More millionaires as nation gets wealthier

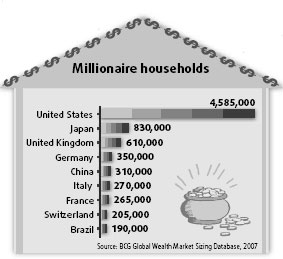

Much has been said about the rise of the Chinese economy, which has surged at double-digit growth rates each year for the past decade. Less well-publicized has been how this economic growth has given rise to a large number of Chinese millionaires, the vast majority of whom are first-generation entrepreneurs. China can now lay claim to having the fifth-most millionaire households of any nation - apart from the United States, Japan, the United Kingdom and Germany.

In our recent report, "Wealth Markets in China: Serving the Rising Wealth", The Boston Consulting Group (BCG) estimates that Chinese millionaire households, as measured by their financial assets (excluding the value of businesses and residential homes), reached 310,000 in 2006.

Indeed, personal wealth in China has been booming, and over the past five years no nation has matched China in terms of wealth creation. BCG research shows that over the past five years, from 2001 to 2006, China has topped the world in the creation of personal wealth at an average compound annual growth rate of 23.4 percent, far outpacing the global average of 8.6 percent over this period, and outstripping Brazil at 22.4 percent and the fast-growing Central Eastern European economies of Hungary, Poland, Slovakia and the Czech Republic at around 20 percent. Interestingly, India and Russia were not represented in the top 10 countries worldwide in terms of wealth growth. All of this despite much Chinese household wealth still being held in cash.

BCG finds that there are three primary drivers of a nation's personal wealth. First, economic growth has a major impact with much of the benefits in any emerging economy flowing through to its entrepreneurs. Second, the national savings rate (as a measure of how much of a nation's wealth creation is retained) is an important factor. Certainly Chinese savings rates are very high - in 2006, the rate reached a whopping 52 percent, up from an already high rate of 37 percent in 2000. (The US savings rate is only about 10 percent and has been declining.)

Finally, growth of household investments is a key driver of wealth creation and with China's booming equity markets, this certainly has been a contributor; however, the impact will have been limited due to the very high cash holdings of Chinese households at 65.2 percent over this period compared to around 20 percent in the US.

Private economy

Much of the Chinese economy is now driven by expansion of the private economy; some economic observers estimate approximately 70 percent of China's economic growth is driven by private enterprises. Given this, it is not surprising that BCG estimates nine out of 10 Chinese millionaire households are first-generation entrepreneurs, many of whom have driven the growth of the economy over the past couple of decades. Indeed, while there are a growing number of billionaires, BCG sees much of the wealth expansion in China to be in households with $5 million to $20 million in financial assets, which typically represents new entrepreneurs. This segment has grown its share of the nation's wealth from 11.3 percent in 2001 to 16.4 percent in 2006.

This raises the question where in China and in which industry sectors has the wealth been created the fastest. Logic would dictate that substantial wealth has been generated in the economically strong southern and eastern coastal cities, in cities such as Wenzhou and Ningbo which are home to many self-made millionaire entrepreneurs.

In terms of industries, analysis of published rich lists shows that many sectors have contributed to the growth of billionaires in China: retail, steel, financial services, Internet, paper, energy, apparel, food, automotive parts and many others - all of which represent roughly 1 to 5 percent of total Chinese billionaire wealth. However, there is one stand-out industry sector that dominates the rich lists: real estate. The real estate industry comprises an astonishing 45 percent of all billionaire wealth supported by the rise of property values and the overall rapid growth of the real estate market.

Looking forward, BCG expects almost twice as many households to become millionaires over the next five years: the 310,000 millionaire households in 2006 should rise at a compound annual growth rate of 15 percent to approximately 609,000 households in 2011 based on sustained economic growth. Interestingly, we should also see the effects of China's economic boom filter through more prominently to the broader population. We expect the mass affluent classes (those with assets of between $100,000 and $1 million) to rise more quickly at a compound annual growth rate of 20 percent, to reach 6.4 million households in 2011. In the early days of most emerging market economies, it is common for the entrepreneurs to benefit most from the economic boom as they take risks to create private enterprises; subsequently, the rest of the population experiences the effects of broad-based economic development in industry and services.

The author is partner and managing director of The Boston Consulting Group's Greater China Practice

(China Daily 11/29/2007 page15)