Crude oil breaks through $98 barrier

|

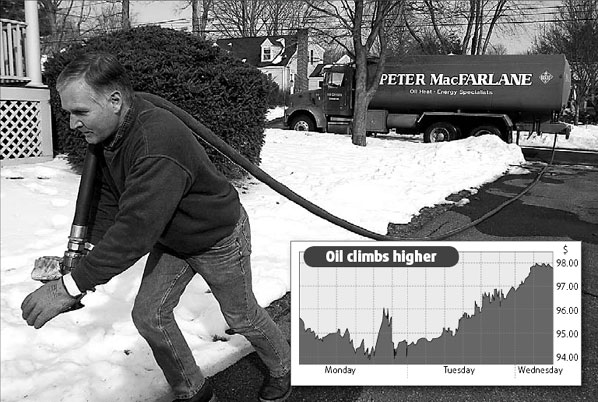

A MacFarlane Oil employee delivers heating oil to a home in Natick, Massachusetts. J B Reed/Bloomberg News |

Crude oil rose above $98 a barrel for the first time in New York as the dollar tumbled to a record low against the euro and producers evacuated platforms in the North Sea, evading a storm forecast to bring waves as high as 36 feet.

BP Plc and ConocoPhillips evacuated oilrig workers, adding to supply concerns before a US Energy Department report that may show inventories fell for a third week. The dollar slumped, pushing up prices of commodities denominated in the currency, on expectations the US Federal Reserve may cut interest rates.

"One-hundred-dollar oil is the big benchmark and the factors driving crude towards that are in force," said Dariusz Kowalczyk, chief investment strategist at CFC Seymour Ltd. "The supply disruption in the North Sea has given further impetus" to prices.

"I think the $100 mark is inevitable now," said Michael Davies, an analyst at Sucden (UK) Ltd in London.

"We're expecting another draw in crude stocks today, and that could be another thing everyone jumps on."

Crude oil for December delivery gained as much as $1.92, or 2 percent, to $98.62 a barrel in after-hours electronic trading on the New York Mercantile Exchange, the highest since trading began in 1983. It was at $98.58 at 11:01 am in London. Futures have climbed 67 percent in the past year.

On Tuesday, oil rose $2.72, or 2.9 percent, to settle at $96.70 a barrel, a record close.

Oil for March 2008 delivery was at $94.90 a barrel and the contract for December 2008 was at $87.97.

Oil has risen 60 percent in US dollars this year compared with 44 percent in euros, 53 percent in yen and 50 percent in British pounds.

"The weakness in the dollar is giving investors the chance to buy oil at a cheaper price," said Tetsu Emori, a fund manager at Astmax Futures Ltd in Tokyo. "Any further declines will only push oil higher."

Workers on ConocoPhillips' Ekofisk A, B and C platforms, as well as Eldfisk A and B, were being moved to land or to safer North Sea sites on Tuesday, said Kurt Mikkelsen, a ConocoPhillips spokesman. BP is moving 150 workers from its Valhall field and expects the platform's 80,000 barrel-a-day oil and gas output to come to a halt soon, spokesman Jan Erik Geirmo said.

The dollar has fallen 9.8 percent against the euro this year, to the lowest since the 13-nation currency came into use in January 1999, on speculation interest rate cuts by the US Federal Reserve will prompt investors to buy higher-yielding currencies.

The dollar's decline increased the attractiveness of commodities as alternative investments. A weaker dollar reduced the costs for buyers paying in other currencies.

Gold reached a 27-year high and silver rose to the most in 26 years as rising oil prices and a slumping dollar deepened concern that inflation will accelerate. Wheat, corn, soybeans and palm oil also gained. Palm oil, used in biofuels, jumped to its highest, gaining 1.6 percent to 3,007 ringgit ($902) a ton.

Smaller cars

Indonesian Economy Minister Boediono said high oil prices are a concern for the country as they drive up production prices.

The surging cost of oil may prompt carmakers to increase sales of compact models, said Honda Motor President Masaaki Kato.

"We need to achieve improved fuel efficiency," he said. "If we make continued, long-term improvements in efficiency we address both.

"We're making efforts to grow out of the dependence on fossil fuels."

Climbing fuel prices may lead to higher airfares, said Japan Airlines Corp Managing Director Tetsuya Takenaka.

"We need to think about raising fares next fiscal year if oil prices remain at high levels," Takenaka said.

Brent crude oil for December settlement rose $1.28, or 1.3 percent, to a record $94.54 a barrel on the London-based ICE Futures Europe exchange at 2:16 pm Singapore time.

'Matter of time'

"The $100 jackpot is imminent now, despite the fact there aren't really oil fundamentals that can justify such a level," said Kamel al-Harami, an independent oil analyst in Kuwait City. "It is only a matter of time for both consumers and producers to be hurt."

Prices have passed the previous all-time inflation-adjusted record reached in 1981, when Iran cut exports. The cost of oil used by US refiners averaged $37.48 a barrel in March 1981, the Energy Department said, or $84.73 in today's money.

Oil has risen 60 percent in US dollars this year compared with 44 percent in euros, 53 percent in yen and 50 percent in British pounds.

"There's so much fund money waiting on the sidelines, it's not worth getting in the way," said Sucden's Davies.

"The weak dollar makes it cheaper for foreign investors to buy oil. The flip-side is oil producers aren't receiving as much profit to invest in future infrastructure."

Bloomberg News

(China Daily 11/08/2007 page16)