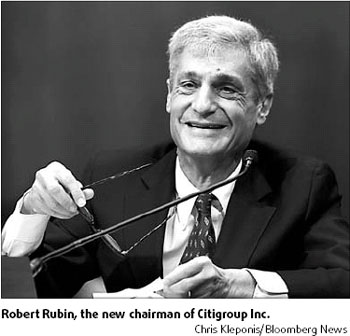

Rubin's return trip to Wall Street

Robert Rubin's career has taken him from Wall Street wizard to the pinnacle of power in Washington, and back.

He may have his hands full as he tries to demonstrate his wizardry one more time.

Rubin was named chairman of Citigroup Inc, following the resignation of Charles Prince as chairman and chief executive of the largest US bank by assets. Sir Win Bischoff, who runs Citigroup's Europe operations, was named acting chief executive.

The change thrusts the 69-year-old Rubin into a bigger role at Citigroup as it struggles with investor discontent over its business plan, a perceived shortage of top management talent - and a potential $11 billion write-down for subprime mortgages.

Since joining Citigroup in 1999, he has focused mainly on strategy, assuming an "eminence grise" role as a close adviser to Prince, while leaving day-to-day business operations to others. Last month, he said he would bet Prince would still be chief executive in 2012 and beyond.

"The board is extremely supportive of Chuck's strategy," Rubin said in a brief interview on Sunday.

"The strategic track is exactly as it ought to be."

And yet, despite his senior role and support of Prince, Rubin has largely preserved the exalted reputation he built from years of fixing global economic crises during the Clinton administration, and prior to that as co-chairman of Goldman Sachs & Co.

'Sharp guy'

"Rubin is a pretty sharp guy. I've met him personally and I was impressed," said Jim Huguet, a money manager at Great Companies LLC in Tampa, Florida.

"He's very intelligent, and obviously has a lot of experience."

Globally, Rubin may be best known as the US Treasury Secretary between 1995 and 1999.

He was the brains behind several multibillion dollar packages to bail out ailing emerging market economies, including in the Asian financial crisis of 1997.

Within the nation's capital, Rubin was perhaps second only to his friend Alan Greenspan, then head of the Federal Reserve, in commanding the ears of politicians and executives on economic policy and financial markets.

Back on the street

Rubin joined Citigroup just after the Clinton administration and Congress agreed to abandon a Great Depression-era rule, known as Glass-Steagall, designed to keep banks, securities firms and insurance companies separate.

Born in New York City on August 29, 1938, Rubin has a bachelor's degree from Harvard College and a law degree from Yale University, and spent a year in Britain at the London School of Economics. He and his wife have two adult sons.

Agencies

(China Daily 11/06/2007 page16)