BP says Q3 profit declined by 29%

BP Plc, Europe's second-biggest oil company, said profit declined 29 percent in the third quarter because of lower refining earnings and natural-gas prices.

Net income fell to $4.41 billion from $6.23 billion in the year-earlier period, the London-based company said yesterday in a statement distributed by the Regulatory News Service. Excluding one-time items and changes in inventories, profit beat analysts' estimates.

Refining margins dropped 5.2 percent as gasoline demand weakened with the end of the US summer driving season, and natural gas prices slid 6.4 percent. BP, the first of the world's five largest oil companies to report, is cutting jobs and breaking up a division to restore investor confidence after Chief Executive Officer Tony Hayward called the third quarter "dreadful".

"Refining margins in the US are under severe pressure," said Herman Bots, an analyst at Theodoor Gilissen Bankiers NV in Amsterdam. "It's very difficult to maintain the level of profits we have seen in previous quarters."

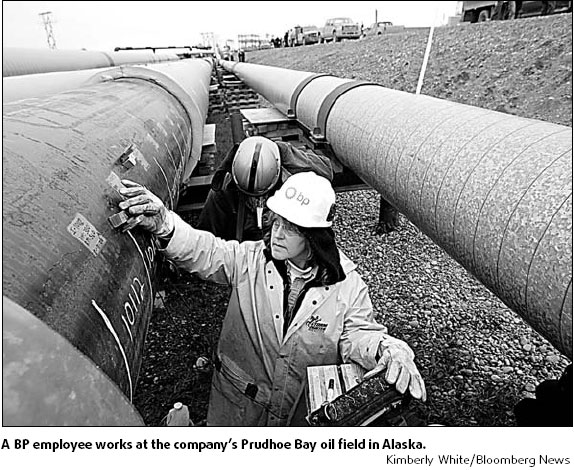

Hayward, who took over from John Browne in May, is seeking to revive profit growth after a Texas refinery blast two years ago killed 15 people, new Gulf of Mexico oil and gas projects failed to start on time and rusty pipelines in Alaska shut Prudhoe Bay, the biggest US oil field.

BP's shares are up 6.6 percent this year, about half the gain of bigger European competitor Royal Dutch Shell Plc, which reports tomorrow. BP shares closed on Monday at 605 pence in London.

Record oil

Oil company share gains this year have been bolstered by surging crude prices, which in New York were an average 6.4 percent higher in the third quarter than a year earlier. Futures reached $90.07 on Friday, the highest since the contract was introduced on the New York Mercantile Exchange in 1983.

Excluding gains or losses from holding inventories and one- time items, profit fell 6.4 percent to $4.21 billion. That beat the $3.98 billion median estimate of 13 analysts surveyed by Bloomberg.

Of the 34 analysts tracked by Bloomberg who cover BP, 18 have a "buy" rating for the shares. Thirteen analysts advise holding the stock, with three recommending "sell".

Shutdowns at refineries in Texas City, Texas, and Whiting, Indiana, cut BP's refining capacity. Oil and gas production from the North Sea was disrupted after the Central Area Transmission System pipeline was shut on July 1 after it was damaged by a ship's anchor.

New projects

BP is counting on new projects scheduled to come on stream over the next year to help it resume production growth after oil and gas output fell last year for the first time in a decade.

The company started pumping crude from Angola's Greater Plutonio field on October 1, the first offshore project operated by BP in the country, the second-biggest oil-producing nation in sub-Saharan Africa.

Bloomberg News

(China Daily 10/24/2007 page16)