Biz people

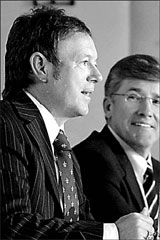

Anthony out, Fraser in at AGL

AGL Energy Ltd, Australia's biggest electricity and gas retailer, said Paul Anthony (left) will leave as chief executive officer after a cut in the utility's profit forecast that triggered its biggest share slump in 20 years.

Michael Fraser, 50, will replace Anthony, the Sydney-based company said yesterday in a statement. Fraser joined AGL in 1984 and most recently worked as group general manager, merchant energy, it said. Anthony will receive a A$5.5 million ($4.9 million) payout, AGL said.

Fraser will have to restore investor confidence after AGL shares plunged 17 percent on October 15 when the company cut a two-month-old profit estimate by 17 percent, citing lower-than-expected retail margins, higher gas costs and reduced earnings from its Papua New Guinea fields.

The company said it's reviewing all operations and will update shareholders next month.

"It's definitely positive that he's going but it's never one individual in the management team who causes such a magnitude of profit downgrade," said Atul Lele, who helps manage the equivalent of $380 million at White Funds Management Ltd in Sydney and is underweight the stock.

AGL shares declined by 14 cents, or 1 percent, to A$12.91 on the Australian Stock Exchange in Sydney yesterday.

Greenspan warns on dollar

Former Federal Reserve Chairman Alan Greenspan (right) said the dollar's decline may reflect a growing unwillingness among foreigners to buy US securities.

"Obviously there is a limit to the extent that obligations to foreigners can reach," Greenspan said in a speech in Washington on Sunday. The dollar's decline to its lowest since 1997 may be "an indication America is approaching this limit".

Greenspan's warning came after the US Treasury reported last week that international investors sold a record amount of US stocks, bonds and other financial assets in August. Central banks and private funds are turning to currencies including the euro as financial markets outside the United States expand.

Total overseas holdings of US equities, notes and bonds fell a net $69.3 billion in August after an increase of $19.2 billion in July.

The Fed's trade-weighted broad dollar index, a measure of the dollar against the currencies of US trading partners, dropped to 99.49 on Friday, the lowest level since 1997. The US currency fell to a record against the euro yesterday, trading at $1.4327 per euro at 10:15 am in Tokyo.

Greenspan first predicted that investors abroad would tire of financing the US current-account deficit in a November 19, 2004, speech in Frankfurt. "A diminished appetite for adding to dollar balances must occur at some point," Greenspan said as Fed chairman at the European Banking Congress.

Greenspan returned to that theme in a London speech in December 2005. After leaving the Fed, he told a conference in Tel Aviv in December that the dollar will "continue to drift downward" because it's unlikely that international investors will continue to increase their allocations to the US currency.

(China Daily 10/23/2007 page15)