Crude passes the $85 mark

Crude oil rose to a record above $85 a barrel as tensions on the Turkey-Iraq border increased concern that supplies may be threatened as global stockpiles decline.

Turkish lawmakers will vote this week on allowing military attacks within a year against Kurdish rebel bases in the north of Iraq, which has the world's third-largest oil reserves. Global fuel inventories fell below a five-year average last month, a period when they typically rise, the International Energy Agency said last Thursday.

Oil is "underpinned by mounting tension between Turkey and Iraq", said Andrey Kryuchenkov, a London-based analyst at Sucden (UK) Ltd. "Bullish fundamentals in combination with the broad weakness in the dollar are already providing a substantial support for crude prices."

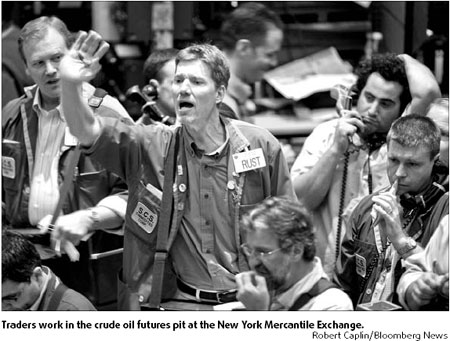

Crude oil for November delivery climbed as much as $1.50, or 1.8 percent, to $85.19 in electronic trading on the New York Mercantile Exchange.

The contract traded at $84.97 at 12:55 pm London time.

Brent crude oil for November settlement rose as much as $1.38, or 1.7 percent, to a record $81.93 a barrel on the London-based ICE Futures Europe exchange. It traded at $81.86 a barrel at 12:48 pm.

Prices rallied last week after 15 Turkish soldiers were killed by Kurdistan Workers' Party rebels. Crude also rose as the IEA said declining product inventories are sustaining high prices and after a US Energy Department report showed the nation's crude stockpiles unexpectedly fell the week before.

"Any tension between Iraq and Turkey and threats of Turkish action in northern Iraq will increase the likelihood" of exports disruption from this area, said Julian Lee, a senior energy analyst with the Centre for Energy Studies in London.

Hedge fund managers and other speculators raised their net-long positions in New York oil futures, the difference between contracts to buy and sell the commodity, according to US Commodity Futures Trading Commission data.

Bloomberg News

(China Daily 10/16/2007 page16)