RBS pays 'big price' to control ABN

Royal Bank of Scotland Group Plc, winner in the six-month takeover battle for ABN Amro Holding NV, now faces the challenge of convincing its shareholders the 71.9 billion-euro buyout adds value.

"The pressure is on these guys," said Colin Morton, a Leeds, England-based fund manager at Rensburg Sheppards, who helps manage about $1.8 billion including Royal Bank stock. "They've got it, they wanted it, they paid a big price for it. The market will be looking over the next 12 to 18 months for them to deliver on the deal."

Edinburgh-based Royal Bank has dropped 13 percent in London trading as it led Banco Santander SA and Fortis in the biggest-ever bank takeover. The stock underperformed the FTSE All-Share Index, down 7 percent since May 25, amid skepticism that the bank and its partners are paying too much.

About 86 percent of investors in Amsterdam-based ABN Amro, the biggest Dutch bank, agreed to the takeover by the three banks, they said in a statement. They will make another announcement by Friday on whether all conditions of the offer, the biggest in banking, were met.

Led by Royal Bank Chief Executive Officer Fred Goodwin, the group trumped London-based Barclays Plc, which abandoned a competing bid valued at 63.2 billion euros on October 5.

The three banks have promised to cut 19,000 jobs and achieve 4.3 billion euros in cost savings and revenue gains by 2010 to make the acquisition pay off.

Losing LaSalle

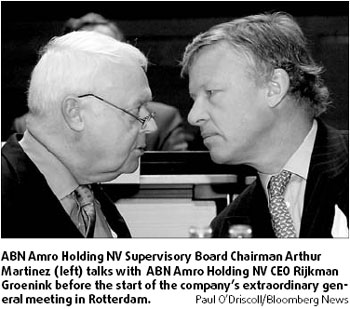

Goodwin began to lay the groundwork to buy ABN Amro in 2005 and was initially most interested in ABN Amro's Chicago-based LaSalle unit. To fend off Royal Bank, ABN Amro CEO Rijkman Groenink agreed to sell the LaSalle unit to Bank of America for $21 billion. Goodwin lost the battle in July for LaSalle after the Dutch high court allowed the deal to proceed.

Rather than cede ABN Amro to Barclays, Goodwin's team revised their bid in July to exclude LaSalle and raised the cash component to 93 percent.

That made it more valuable to ABN Amro's shareholders than Barclays's mostly stock bid, especially as the US subprime-mortgage crisis triggered a credit crunch the pulled down banking shares.

With the greater cash component, Goodwin and his partners have to raise a combined $40 billion in takeover financing amid higher borrowing costs. Royal Bank sold about $7 billion of bonds on September 26 to help fund the takeover.

"It was a tricky deal to start with, and then they didn't get LaSalle and then came the liquidity crisis," said Mike Trippitt, an analyst at Oriel Securities Ltd who has a "buy" rating on Royal Bank stock. "Nobody would have been surprised if they had walked away."

The group is paying about three times ABN Amro's book value, higher than the multiple of 2.35 that JPMorgan Chase & Co paid in its $58 billion acquisition of Bank One Corp in 2004. The acquisition of ABN Amro would be the largest financial-services takeover, exceeding the $69.9 billion combination of Citicorp Inc and Travelers Group Inc in 1998.

"The Royal Bank-led offer is a very expensive transaction," said Robert Talbut, chief investment officer at Royal London Asset Management, who helps manage about 31 billion pounds. "The risk-reward doesn't add up."

Royal Bank shares fell 1.6 percent to 560.5 pence on Monday in London, valuing the bank at 53.2 billion pounds. They are down 16 percent this year. Fortis stock declined 0.9 percent to 22.51 euros in Amsterdam, valuing the company at 49.6 billion euros, and Santander dropped 0.6 percent to 13.86 euros in Madrid, giving the bank a market value of 86.7 billion euros.

Break-up plan

The break-up plan assigns ABN Amro's Brazilian and Italian units to Banco Santander, Spain's biggest bank. With its slice of the acquisition valued at 19.9 billion euros, Santander will expand into Italy and double its market share in Brazil.

Fortis, the largest Belgian financial-services company, will pay 24 billion euros for the Dutch consumer-banking arm and ABN Amro's asset-management and private banking units to create a "Benelux leader".

Royal Bank, Britain's second-biggest bank, is paying 16 billion euros for ABN Amro's Asian and investment-banking operations.

"The three banks have different needs, and each has gotten something that is valuable to them," said Nancy Havens, managing member of New York-based hedge fund Havens Advisors LLC, who helps manage about $350 million and tendered her ABN Amro stock. "The sum of the parts is more valuable than the whole."

Bloomberg News

(China Daily 10/10/2007 page16)