New York crude rises on storm risk

Crude oil rose a second day in New York as stockpiles in the US Midwest fell to a 21-month low and a storm formed south of fields in the Gulf of Mexico.

Supplies at Cushing, Oklahoma, the receiving point for benchmark West Texas Intermediate oil, dropped to 18.1 million barrels last week, the government said yesterday. A tropical depression about 274 kilometers east of Tuxpan, Mexico, may strengthen as it moves southwest, the US National Hurricane Center said.

"The last storm Humberto picked up so fast so that's put a bit of fear into people," said Rowan Menzies, commodity analyst with Commodity Warrants Australia Ltd in Sydney. "The oil bulls aren't ready to capitulate completely."

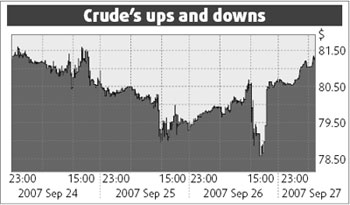

Crude oil for November delivery gained as much as 80 cents, or 1 percent, to $81.10 a barrel in after-hours electronic trading on the New York Mercantile Exchange. It was at $81.05 at 12:25 pm in Singapore.

The contract rose 77 cents, or 1 percent, to $80.30 yesterday, the first gain in four days. It touched $78.44, the lowest since September 17, after the inventory report showed US stockpiles unexpectedly gained 1.8 million barrels last week as refiners slowed production to a six-month low. The nation's inventories are down 7 percent the past two months.

'Very small rise'

The stockpile gain "is only a very small rise in comparison and that's why we're seeing oil prices staying around $80", said Sara Nunnally, editor of Baltimore, Maryland-based commodity newsletter Material Profits. Risks "of hurricanes perhaps or some tightness at some of the delivery points have helped push up the price of oil quite a bit in the last couple of weeks".

As well the depression in the Gulf of Mexico, the National Hurricane Center said an area of low pressure south of Key West, Florida, may strengthen as it heads northeast toward the Atlantic. The center is also tracking Tropical Storm Karen, 1,722 kilometers east of the Windward Islands, and an area of "disturbed weather" in the eastern Caribbean.

"We still have a little left of this terrible hurricane season to endure" and that may be supporting prices, said Chris Mennis, owner of oil broker New Wave Energy LLC in Aptos, California.

Prices jumped $2 in the final hour of floor trading on Wednesday, in a rally that coincided with a late advance in US equity prices.

Stocks rose

US stocks rose for the first time this week after General Motors Corp agreed on a contract with striking workers. The Standard & Poor's 500 Index added 8.21, or 0.5 percent, to 1,525.42.

"There was some comment about fund trading being heavily influenced by the Cushing stockpiles being down so much," New Wave's Mennis said.

"It's hard to be so bullish when refiners are cutting back their runs so much."

US refiners used 86.9 percent of their plant capacity last week, the lowest since mid-March, according to Energy Department data. Analysts had forecast a rate of 88.6 percent.

Brent crude oil for November settlement rose as much as 75 cents, or 1 percent, and was up 73 cents at $78.16 a barrel at 12:27 pm Singapore time on the London-based ICE Futures Europe exchange.

The contract fell yesterday 19 cents to $77.43, the lowest close since September 17.

Bloomberg News

(China Daily 09/28/2007 page15)