Show me the money

Part of the lyrics of a popular online song named Stock Investor Old Zhang goes: "Begin my job at 9:30 am, leave at 3 pm - I am Old Zhang, one of 60 million Chinese stock investors" In a catchy rhythm, Old Zhang explains how an ordinary investor feels about the booming Chinese stock market.

But now, he might have to change the lyrics. Today, there are more than 100 million speculators as the stock market continues to sizzle and capture the imagination of a nation.

After a 5-year downturn, the market bounced back and has soared since early 2006. Phrases, such as "bullish, bearish market", "blue-chip share" and "rat trading" became regular terms in ordinary people's conversations.

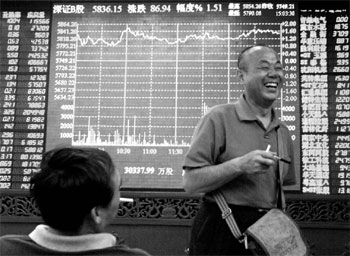

|

An investor is happy to face the surging index. Wu Changqing |

Some wrote songs, and others produced TV dramas in a bid to narrate small-investor stories and reflect the ups and downs of their emotions, along with the fluctuation of Chinese stock market. More and more Chinese shareholders, such as "Old Zhang", have jumped into the stock market to become full-time investors.

Last week, after returning to the publishing house as a marketing manager, 30-year-old Fang Jinsheng had spent one year and three months at home as a full-time stock investor.

He's now back at his familiar job and feels his life is enriched again by routines: getting up at 7:30 am, having breakfast, catching crowded bus and dealing with troublesome clients.

Fang came to Beijing in 2000 after graduating from Anhui University. Before 2006, Fang's only knowledge of the stock market came from workmates and friends. He used to listen to their tales of wins and losses.

"Since the beginning of 2006, I kept hearing stories of people making fortunes rapidly from the stock market, it sounded like cash was flying in the air," he says. Fang was astonished when one of his buddies earned 20,000 yuan ($2,670) in one week.

Unable to resist the temptation of overnight wealth, Fang, who is from a traditional family in a small village, disregarded his parents' opposition, joined the long queue in a bourse in June 2006 and put 30,000 yuan ($3,973) - half his annual income - into stock market.

Less than two weeks after Fang started his stock investment, he raked in 5,000 yuan ($670) of profit. He said it was like "pies dropping from heaven" when he bought a brand new cell phone with the profits.

Three months later, Fang quitted his job after gaining another 25,000 yuan ($3,350). "Compared to my profit from the stock exchange, my salary then was nothing," Fang says.

Fang's timing was perfect. One year before Fang opened his stock account, the Shanghai Stock Exchange index dropped to its lowest point: 988.23. By the end of 2006, the index had climbed to 2500 points, its highest point in five years.

Wide optimism about the domestic economy gradually melted ordinary people's indifference to, and hesitation towards Chinese stock market.

According to China Securities Depository and Clearing, there were 857,000 new A share accounts opened in Shanghai and Shenzhen stock exchange in 2005. But by the end of 2006, the number had tripled, and 2.76 million new accounts were opened in the two major exchanges. The total number of individual stock investors reached 8 million, 5.2 percent of Chinese population.

"The steady increase of the domestic economy spurs the stock market, which lays a platform for Chinese people to release their long needs of investing," says Yin Zhongli, researcher of the Institute of Finance & Banking, Chinese Academy of Social Sciences.

"No one could really tell when the bullish market will end, but one thing is for sure: most small investors are behaving irrationally."

Fang's fortunes turned, and he fell into a panic above losing money every day. Since all buyings and sellings could be done online, Fang didn't leave the house except to eat meals at a small restaurant nearby his home. "I began to live an eremitic life, isolated from the world outside," he says. Fang recalls that he couldn't bear the panic and loneliness.

On May 30, 2007, as central government tripled the stock transaction stamp tax, the stock market took a big slump. Fang's share dropped 10,000 yuan ($1,330) within a couple of hours. That was enough, and Fang decided to go back to work. He still invests in stocks, but it is not his whole life anymore.

Unlike Fang, Peng Wei, 41, has accumulated 10 years' investing experience. He opened his first account in November 1994 and withdrew from the depression in 2003.

Peng used to be a well-paid department manager at a State-owned company. In 2004, after his company was closed down, Peng tried a few business ventures, but they all failed. Then, he turned to the stock market.

"Considering that the Chinese stock market would return to its value, I decided to return," he says.

In 2006, Peng came back to the booming market. It only took two months to double his first investment. Peng's successes in the stock exchange have become famous among his friends and neighbors.

Some of his friends began to entrust their accounts to Peng. Most have received at least 30 percent profit in 2006. Peng receives a commission.

Over weekends, Peng used to go to the teahouse and play chess with his friends. Conversation was mostly about the stock market. They all believed it would maintain its bullish ways. In 2007, the Chinese stock market soared at a tremendous speed.

During the first half, A-share account numbers had jumped to 18.68 million, six times the total number of last year. On February 26, the benchmark Shanghai Composite Index breached 3000 points, and it reached 4000 points 32 exchange days later.

"The stock market may be too speculative right now," Peng says.

Chinese government has been trying to use monetary-policy instruments to cool down the stock market; the well intentioned measure aims to deflate the stock market bubble, but it has not slowed investor enthusiasm.

This month, as the Shanghai index climbed over 5400 points, Chinese regulators are quickly approving Initial Public Offering (IPO) to encourage more companies to list on two major exchanges.

Peng is confident the stock market will not crash for at least two years, especially with the 2008 Beijing Games around the corner. Some believe the market will climb to at least 10000 points. Others warn the bubble is about to burst.

"There is no hell; there is no heaven; it is not a casino; it is not a bank; I won't leave stock market, neither my job..." Investor Old Zhang sings as the final verse of his song.

(China Daily 09/25/2007 page20)