Will banks now be in driving seat?

Now that the Federal Reserve is reducing interest rates, it's tempting to assume the largest US banks will lead the stock market for a change.

"Investors buying banks in anticipation of Fed easing have history on their side," Howard K. Mason, an analyst at Sanford C. Bernstein & Co said in a report published on Tuesday (local time).

They beat the Standard & Poor's 500 Index by 6 percentage points on average during the last five rounds of rate cuts, he wrote.

Then the report - focused exclusively on Bank of America Corp, Citigroup Inc, JPMorgan Chase & Co, Wachovia Corp and Wells Fargo & Co - highlights two risks that might curtail the gains this time: recession and valuation.

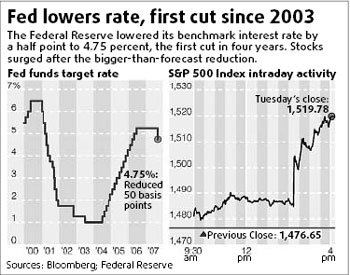

Banks had their day on Tuesday after the Fed lowered its benchmark rate by half a percentage point, surprising those who called for a quarter-point cut.

The S&P 500 Banks Index climbed 4.2 percent, the fourth-largest advance among 24 industry groups in the S&P 500. Another S&P industry index whose members include Bank of America, Citigroup and JPMorgan Chase, the three biggest US banks, had the steepest rally: exactly 5 percent.

Before then, both gauges were among the worst performers this year.

The bank index, with a 12 percent drop, ranked last. The other indicator, known as the Diversified Financials Index and including brokerage and money-management firms, was third from the bottom with a 10 percent decline.

The threat of recession has increased as a housing-industry slump, exacerbated by the subprime-mortgage market's woes and a related loss of access to credit, stretches into a second year.

Consider what Ethan Penner, who built Nomura Securities International Inc. into the largest US real-estate lender during the 1990s, told a New York audience.

Housing is "an unmitigated disaster", said Penner, a principal at Lubert-Adler Partners LP, a real-estate manager based in Philadelphia.

The world economy "is probably at the scariest point since the Depression", he said.

Bernstein's Mason, based in New York, isn't so concerned. In the report, he wrote that his group of five banks beat the S&P 500 between November 2001 and June 2003, when the Fed cut rates to revive a shrinking economy.

Valuation is a bigger issue for Mason. More specifically, he noted that share prices are relatively high by comparison with tangible book value, a gauge that strips out the value of some takeover-related assets.

These ratios ranged from 2.2 times for New York-based JPMorgan Chase to 3.5 times for Bank of America, based in Charlotte, North Carolina, and Wells Fargo, based in San Francisco, according to Ed Loh, a colleague of Mason's.

Put them together with Citigroup and Wachovia, both based in New York, and the stocks trade at an average of 3.1 times tangible book value, Loh wrote in an e-mail. This exceeds the S&P 500's ratio of 2.8.

Banks tend to beat the S&P 500 by the widest margin when their ratios are among the lowest in the index, the report said.

Because that isn't true now, even someone looking for the group to outperform now - as Mason does - must temper his optimism.

David Wilson is a Bloomberg News columnist. The opinions expressed are his own.

(China Daily 09/20/2007 page16)