Niche markets, high profits key for Baring

Baring Private Equity Asia Group (Baring Asia), the Hong Kong-based Asian private equity group with $1 billion under management, recently announced a joint investment with the International Finance Corporation (IFC). The two will invest $47.2 million in Dongyue Group Ltd, a refrigerants producer in China. It's Baring's 20th investment in China since 1999. The company has set up three Asian private equity funds, raising a total of $1.05 billion.

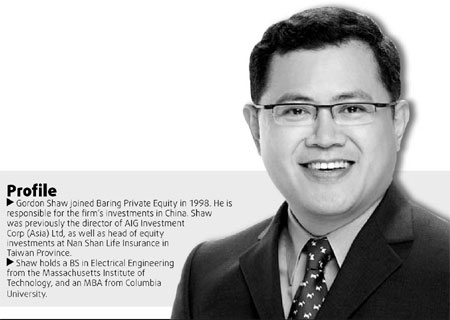

Baring usually invests between $20 million and $50 million in each company valued at between $50 million and $300 million. It expects the value of its investment to appreciate at least three times within five years. Gordon Shaw, managing director of Baring Asia, spoke with China Daily reporter Jin Jing in Shanghai about the group's investment strategy and business model in China.

Q: What's your investment strategy in China, and how do you choose investment targets?

A: Most of our target companies are the top companies in niche markets. We favor local companies with special characteristics, such as high profitability and a sound sales channel. Usually, we target companies expected to have annual growth of 30 percent to 50 percent. For example, we have invested in a company that produces car accessories in Ningbo, we have done research and believe it will have a 15 to 50 percent growth rate because of its good client relationships and the bright prospects of the car industry.

We have said that we hope the company will gain a listing within five years. However, we do not usually sell our stake after the company lists. For some companies, we will continue to hold the stake.

The best channel to find out about these companies is through referrals from industry counterparts, which have higher credibility. More importantly, they can help introduce Baring to other companies. Sometimes, we get to know the company through personal relations. For example, we were introduced to Minth Group Ltd, which we invested in in 2005, by their chairman's private banker.

The last step is to pick your targets. We only put effort into projects that we are more likely to win after research, and then we will spend lots of time talking and communicating with the company, and let them believe their profits will increase after our investment.

Currently, about 50 percent of the funds raised from the Baring Asia Equity Fund III have already been invested in projects in Asia. Of the total funds invested by Baring last year, 70 percent was invested in China. The Baring Asia Equity Fund IV is expected to be launched soon.

Q: What industry is the most attractive for investment in China?

A: We have gradually shifted our focus to relatively less developed provinces and second-tier cities, such as Shandong and Sichuan, because the acquisition costs are much higher in first-tier cities like Shanghai and Shenzhen.

We mostly look at the traditional industries, such as chemicals and education, and are becoming quite positive about companies in the service industry, which will probably be better than manufacturing companies in the near future. Consumer goods will see good development but the price is currently too high for us.

The new energy industry is also on our radar now. As oil prices rise, alternative energy will become more competitive.

Q: What's your competitive edge over rivals in the China market like Carlyle and Blackstone?

A: Local decision-making is the key advantage for us. We have offices in Hong Kong, Shanghai, Tokyo and Singapore. Meanwhile, the structure for many other international private equity funds is like a pyramid, with only a few decision makers at the top of the pyramid. They are usually in New York or Washington DC, which is far away from the market. And we are quite familiar with market changes because we are localized.

Once we decide to invest in a company, we spend a lot of time talking with the company - the process sometimes takes as long as three years. This relationship isn't easily broken. For example, before taking a 25 percent stake in Airtac, the Chinese manufacturer of pneumatic components, I've talked with them for three years. We agreed on the price. Since we made the investment in 2006, that company's price-earnings multiplier has gone up five times.

The most important thing in our business is to pick out the high-profitability companies and keep working with management to improve operations. Moreover, in developing relations with our early stage projects, our team usually has a quicker response ability compared with our counterparts.

(China Daily 09/18/2007 page15)