Sichuan heat in the pipeline

For people in Hong Kong, the name Sichuan conjures up a delicious sensation - it is most often associated with hotpots and spicy chili. Yet before long the province could provide another kind of heat for virtually every Hong Kong kitchen.

The source would be natural gas transported by pipeline from newly drilled wells and pumping stations in mountains covered by stair-stepped paddies and chili fields.

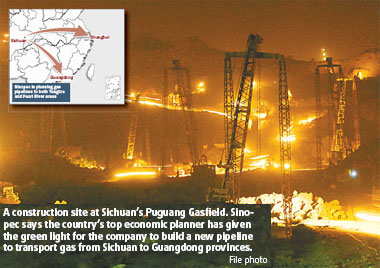

An exclusive source from Asia's top refiner China Petroleum & Chemical Corp, also known as Sinopec, says the country's top economic planner has given the green light for the company to build a new pipeline to transport gas from Sichuan to Guangdong Province.

"As reserves from Sichuan's Puguang Gasfield may prove to be larger than expected, Sinopec can pipe gas from Sichuan to not only the Yangtze River Delta area, but also the Pearl River Delta," the Sinopec insider says.

"By the end of 2009, Sinopec may supply natural gas to Guangdong, Hong Kong and Macao," says the source, citing documents approved by the National Development and Reform Commission (NDRC), the country's top economic regulator.

Sinopec spokesman Huang Wensheng partly confirmed the news.

"We are considering such a plan, but the prerequisite is that there should be enough gas extracted from the Puguang Gasfield (to feed both the Yangtze River and Pearl River areas)," Huang says.

Judging by the current situation, it is very likely Puguang will yield more natural gas than previously estimated, the spokesman says.

"I cannot say the exact reserve potential of Puguang right now. But our exploration staff are confident (more reserves will be discovered at Puguang)."

Chen Ge, company secretary of Sinopec, agrees. He said earlier that Puguang offered great potential.

Sinopec's Puguang Gasfield in Sichuan now has an estimated exploitable reserve of 356 billion cubic meters (bcm), the country's second largest, according to information from the Ministry of Land and Resources.

China's largest current gasfield, the Sulige Gasfield in the Inner Mongolia Autonomous Region, has proven reserves of 533.6bcm.

If another pipeline is built to Guangdong, it will also supply Hong Kong and Macao "because they actually belong to the same regional market", Huang says.

Separate line

The planned Sichuan-Guangdong pipeline is separate from, rather than a sub-line of, the Sichuan-East China pipeline, Huang says.

As Asia's top refiner and the nation's second-largest oil and gas producer after China National Petroleum Corp (CNPC), Sinopec has already decided to build a 1,702-km pipeline by 2010 to transport natural gas from Sichuan to the eastern part of China, with a designed annual transport capacity of 12 bcm.

The cost of the project is estimated at 65.7 billion yuan, according to recent reports from Xinhua News Agency.

With several sub-lines, the Sichuan-East China pipeline is designed to supply gas for Sichuan, Hubei, Jiangxi, Anhui, Jiangsu and Zhejiang provinces and Chongqing and Shanghai municipalities, according to Xinhua.

Sinopec's shareholders have approved a plan to raise 20 billion yuan to fund the development of Puguang and a pipeline linking it with Shanghai, Chief Financial Officer Dai Houliang was quoted by Bloomberg as saying.

Huang did not release investment figures on the Sichuan-Guangdong pipeline, because research on the project is still under way and further details are not available.

The anonymous Sinopec source says that in preparation for delivering gas to Guangdong, Sinopec has formed partnerships with the China National Offshore Oil Corp (CNOOC) and Guangdong provincial government to jointly lay a pipeline network in the booming province.

"The distribution channel will not be smooth unless the pipeline network is constructed," the unidentified Sinopec source adds.

Han Xiaoping, a veteran energy analyst with China5e.com, one of the top energy websites in China, says cooperation between Sinopec, CNOOC and Guangdong will play a positive role in facilitating energy supply to the province and boosting business.

"If Sinopec is to feed the province, it needs CNOOC's pipeline facility in Guangdong to reach end customers. The other way around, CNOOC's LNG (liquefied natural gas) imports may feed interior regions through Sinopec's pipeline," Han says.

Two sources

It would be an ideal combination for Guangdong to have both LNG supplied from overseas and piped gas from China, the analyst says.

"It would be a two-legged supply strategy securing the province's energy safety," he says.

In parallel, Sinopec's bigger rival CNPC is planning a new gas link from northwestern Xinjiang to Guangdong, known as the second East-West gas pipeline.

No confirmed details about CNPC's new pipeline are available.

"The Guangdong market is short of energy sources. The huge market demand will accommodate supplies from diversified market players," says Liu Gu, a senior energy analyst with Guotai Jun'an Securities.

Yao Daming, an oil analyst with the Guangdong Oil and Gas Association, agrees that there is enough gas demand in Guangdong to accommodate the supply from both Sinopec and CNPC.

"Unlike provinces in North China, Guangdong is in desperate need of all kinds of energy resources. We can use natural gas for not only home use, but also for industrial purposes such as generating electricity and making chemicals," Yao says.

As a cleaner energy resource, natural gas is winning favor from both industrial users and consumers, so the nation is pinning high hopes on gas to enhance energy efficiency and reduce emissions.

The surging demand for gas is pushing major producers such as CNPC and Sinopec to extract more.

CNPC, the nation's largest oil producer, increased natural gas production by 16.5 percent to 22.6 bcm in the first half of this year. The company plans to increase gas output for the year by 23 percent to 54 bcm.

China plans to increase gas use to 5.3 percent of the country's total energy consumption by 2010 from its current 3 percent.

The nation uses coal to generate two-thirds of its power.

The NDRC predicts China's natural gas demand will reach 100 bcm by 2010, compared to 60 bcm produced last year.

By 2020, demand will hit 200 bcm, with production at 140 bcm. The gap can only be bridged with either more imports or increased local production, analysts say.

(China Daily 09/07/2007 page42)