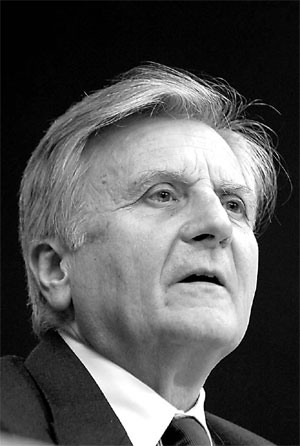

Trichet forced into caution on rates

European Central Bank President Jean-Claude Trichet has made a habit out of telling investors what to expect on interest rates. Now markets are dictating the terms.

Trichet, unsure of how the soaring cost of corporate borrowing will affect Europe's economy, may shelve an interest- rate increase planned for this week, analysts said. Confidence among consumers and companies has already taken a hit, reports on Friday showed.

"Markets haven't settled enough for the ECB to hike rates," said Michiel de Bruin, head of government bonds at the Netherlands unit of London-based F&C Asset Management. "You have to be very sure there'll be no impact on the real economy from this crisis, and it's too soon to say that."

Economists say Trichet will wait. Just 11 out of 55 surveyed by Bloomberg News predict a quarter-point increase when the 19-member governing council meets in Frankfurt on September 6.

"Everyone was expecting a rate rise in September because Trichet signaled one," said Stewart Robertson, an economist at Morley Fund Management Ltd. in London. "Things have changed. In the current circumstances, it would be an absolutely bloody-minded thing to do."

Trichet has flagged the past eight rate increases by pledging "strong vigilance" on inflation. He used those words at a press conference on August 2, signaling rates would rise in September for the ninth time since late 2005.

He retracted the remark last Monday, saying the ECB isn't "pre-committed" to higher rates. "What I said on August 2 was before market turbulences."

The Morgan Stanley Capital International World Index declined 11 percent between July 19 and August 16 as credit became more expensive. Overnight borrowing costs between banks in Europe rose as high as 4.62 percent on August 9, compared with the ECB's benchmark rate of 4 percent, prompting the central bank to inject cash into money markets.

"Economic fundamentals still suggest the ECB ought to raise rates, but it can't ignore what's happened on financial markets," said Sandra Petcov, an economist at Lehman Brothers International in London. "There's been a substantial re-pricing of risk and if banks tighten lending standards for households and firms, that could result in the equivalent of a rate increase."

Trichet's challenge may be easier than that confronting US Federal Reserve Chairman Ben Bernanke, who is under pressure to cut rates to shore up the economy, said Annamaria Grimaldi, an economist at Intesa Sanpaolo SpA in Milan.

'Act as needed'

"The Fed is faced with the possibility of having to invert its monetary policy, but in Europe, even if rates are left unchanged in September, it's probably just a matter of postponing" an increase, Grimaldi said.

Bernanke told the Kansas City Fed's symposium in Jackson Hole, Wyoming, on Friday that he will do what's needed to prevent the credit rout from undoing the six-year American economic expansion.

The Bank of Japan has already stepped back from raising rates and economists expect the Bank of England to leave its benchmark rate at 5.75 percent on September 6, the same day the ECB meets.

"The ECB will reluctantly keep rates at 4 percent, while hinting at the possibility to resume tightening as soon as markets return to normal," said Aurelio Maccario, an economist at UniCredit SpA in Milan. "The ECB's main intention remains to keep inflationary risks in check."

The Frankfurt-based ECB is concerned inflation will accelerate beyond its 2 percent limit after the economy expanded at the fastest pace since the turn of the decade last year, giving companies more room to raise prices and wages. Money supply growth, which the bank sees as a gauge of future inflation, accelerated to the fastest pace in 28 years in July.

Bloomberg News

(China Daily 09/04/2007 page16)