Tom Online buyout plan may help restructure

Tom Group's recent efforts to buy out Tom Online may make the company, which took over eBay's auction business in China last year, retreat from the capital market. But experts said the buyout might mark the beginning of Tom Online's business restructuring.

Tom Group's recent efforts to buy out Tom Online may make the company, which took over eBay's auction business in China last year, retreat from the capital market. But experts said the buyout might mark the beginning of Tom Online's business restructuring.

"I think the buyout would save Tom Online from blindly catering to the demands of the capital market and help the company focus on its restructuring," said Liu Bin, chief analyst of BDA China.

"In fact, Tom Online still has its advantages like its good relationship with cell phone operators, abundant media resources and its own independent channels. If the company could find a way to use its resources well and develop the wireless Internet service that the consumers really need, I think Tom Online would be able to get out of its current trouble," Liu said.

the consumers really need, I think Tom Online would be able to get out of its current trouble," Liu said.

Trading of Tom Group and Tom Online shares was halted on Hong Kong stock exchange and NASDAQ after the news came out last week that Tom Online would be bought out and returned to the control of its parent company, Tom Group.

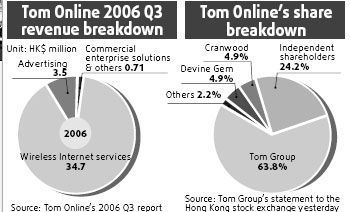

Tom Group, owned by Asia's richest man, Li Ka-shing, yesterday offered $201 million to buy all the shares it doesn't own in Tom Online. The company said in a statement to the Hong Kong stock exchange that it seeks to buy Tom Online shares at HK$1.52 each, or 33 percent above the stock's closing price on March 2.

Although the final deal is yet to be approved by Tom Online's shareholders, insiders believe it's unlikely to be blocked.

"Tom Online's revenue and net profit have slid by 42 percent since July, when China Mobile and China Unicom rolled out new rules that tighten the control over Internet value-added service providers in China," said Liu.

"And I don't expect there will be a turnaround for Tom Online's declining business performance until the second half of this year. Given that, I think most investors will be willing to hand back their shares, especially when there is an attractive premium."

In July, China's largest cell phone operators released several new rules that force mobile service providers to seek clear confirmation from subscribers signed up for new services, and introduced much stricter control of usage charges.

According to an internal survey by China Mobile, the stipulation of requiring clear confirmation from subscribers alone would result in a 70 percent loss of new users for mobile value-added service providers.

"For a long time, 'illegal marketing' has been a common practice for Chinese value-added service providers to get new users without the knowledge of most consumers about the charges," said Liu.

This created mounting public pressure that forced the Ministry of Information Industry and cell phone operators to act.

Tom Online's total revenue in the third quarter of last year was $38.95 million, a decrease of 15.2 percent year-on-year and 22.3 percent from the previous quarter. Wireless Internet revenues totalled $34.71 million, representing a 19.6 percent decrease year-on-year.

(China Daily 03/13/2007 page15)