The Chinese business press likes to talk about the economy's "new normal", while the true picture of the economy is not normal at all, according to economic experts.

In fact, the country's economy is at its most critical moment since the 2008 global financial crisis. To undertake intended reforms, the experts say, a slowdown in GDP growth is needed. At the same time, for reforms to succeed or at least to avoid problems the country also needs to maintain a certain growth rate.

The approaching two sessions, or two-week meetings of the National People's Congress and the National Committee of the Chinese People's Political Consultative Conference, will focus on how that can be done this year.

The central government will probably set its most modest year-on-year GDP increase target in 11 years, adjusting it down to 7 percent from last year's target of 7.5 percent, said Wei Jianguo, vice-chairman of a government think tank, China Center for International Economic Exchanges, and former vice-minister of commerce.

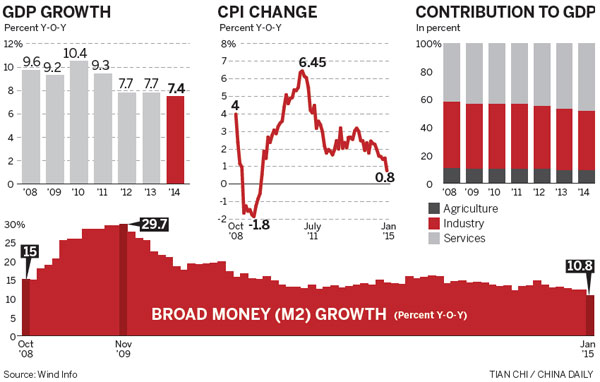

The actual GDP growth last year reached only 7.4 percent overall, the slowest pace in 24 years. This year, the central government may be less tolerant of GDP growth lower than 7 percent.

"Seven percent should be the bottom line. Otherwise, unemployment and other social factors could rise and become a barrier to reform," Wei said.

In the long run, China will be characterized by an economy that is more focused on innovation, productivity gains and efficiency in using resources, economists said.

The two sessions maybe different from the meetings of previous years because Chinese policymakers are aware of the risks facing the economy during the transition, particularly the high leverage ratio and various existing "bubbles", said WangTao, chief economist in China for UBS AG, a global financial services company.

"The government will be more disciplined in its policy responses, and the threshold for the traditional type of credit expansion and quasi-fiscal stimulus will be quite high in the future," she said.

"But the government will not shy away from using infrastructure spending and macro policies to support growth to resolve the risks," Wang said. "We expect the government to provide additional liquidity, make more cuts in the interest rate and facilitate local debt restructuring and securitization in 2015."

Some economists have already complained that government was too slow in shoring up the necessary growth. Deflation is a concern that may be aired by policymakers and advisers during the coming two sessions, they said.

The government's target for consumer price inflation for this year may be lowered from 3.5 percent last year to 3 percent, experts said.

But China is currently edging close to deflation, the central bank's newspaper, Financial News, said on Wednesday.

This is caused by two factors, said Chen Kexin, an economist with Lange Research Center in Beijing. One is falling commodity prices in the global market, while the other "is the fact that perhaps the central government has remained too tight on the money supply for too long", Chen said.

chenjia1@chinadaily.com.cn