Firms unsure over new social security scheme

Updated: 2011-11-04 08:06

By Lan Lan (China Daily)

|

|||||||||||

Local governments have not made all the arrangements yet for receiving payments or registering people, Xu said.

The tax authorities have been required to get the system working by the end of the year but companies will have to back-pay contributions to Oct 15 when the rules went into effect, he said.

According to the regulation in Beijing, the salary cap for paying social security contributions is 12,603 yuan ($1,978) in 2011.

For each employee earning that or higher, employers have to pay about 4,096 yuan, and the employees need to pay about 1,326 yuan, per month. The majority of foreign workers earn at least the cap and, therefore, companies hiring them will face greater costs.

Roughly, the total added cost for one foreign worker would be about 65,000 yuan per year: about 49,000 yuan to be paid by the employer and about 16,000 yuan to be paid by the employee.

Around one third of the companies surveyed said they hope that this additional cost would come to less than 5 percent of an employee's annual salary while a quarter of the firms expected that it would not exceed 10 percent.

For contribution purposes, human resource managers tend to split foreign workers into two groups, those hired overseas and those hired in China.

For locally hired employees, more than half of the surveyed companies will have to pay the employees' portion themselves. For expatriated employees, most companies are adopting a wait-and-see attitude.

Just 5 percent of companies surveyed are considering compensating employees to ensure their income won't suffer.

"A quarter of employers said they don't think the new regulation will make a lot of difference, over the long term, on whether workers will stay in China," Mikelonis said.

Other countries have similar regulations, allowing foreigners the same social welfare benefits as nationals, she said.

The business community has expressed concern at the extra costs, Daniel Cheng, managing director at the Canada China Business Council, said.

Various business organizations, such as the China-Australia Chamber of Commerce in Beijing, have written to authorities over the regulation.

Brendan Mason, general manager of Cochlear Medical Device, an Australian company in Beijing welcomed the scheme but had concerns.

"It's really good what the government is trying to do, but one plan cannot work for everybody and things need to be improved over time," Mason said.

Foreigners who are employed by small companies might decide the new policy is good for them, but foreigners working for larger companies, and covered by global insurance, may be unwilling to pay, he said.

A foreign journalist in Beijing, who declined to be named, said he would have no problems paying his portion but was unsure if the employer would see the added cost as a burden.

Most foreigners in China do not plan a long stay in the country and are unsure if they can redeem payments if they leave. Foreigners have to have a permit to work so unemployment benefit seems contradictory.

Xu, of the management center, said individual contributions will be refunded when workers leave China but he did not say exactly how that would work.

A project director at Mercer said that problems with the system will be sorted out.

"China is on course to improve its existing security net, including security for its own citizens. These loopholes will be ironed out," James Xu said.

However, the new policy might speed up a trend to hire local employees, he said.

"The new costs will cause complaints from foreign companies, but complaints are invalid as it's common practice and a product of globalization," said Li Xiaogang, director of the Foreign Investment Research Center at the Shanghai Academy of Social Societies.

More Chinese companies are investing overseas and Chinese companies also need to pay social security in these countries, Li said.

However, China's existing social security needs to be improved. For instance, cities have different standards while companies have employees in different cities, making it hard for companies to implement the scheme, he said.

China has signed bilateral agreements with the Republic of Korea (ROK) and Germany for social insurance exemption.

Workers from Germany are exempt from pension and unemployment contributions in China for the first 48 calendar months, while those from the ROK are exempt from pension contributions.

Other countries are also talking about similar treaties, but the exact figure is difficult to estimate, Mikelonis said.

More than 230,000 foreigners had Chinese work permits at the end of 2010.

- Hu urges efforts to promote financial stability

- More grassroots delegates for CPC

- 4 killed, 55 trapped in coal mine

- Concerns over social security scheme

- China urges support for Afghanistan

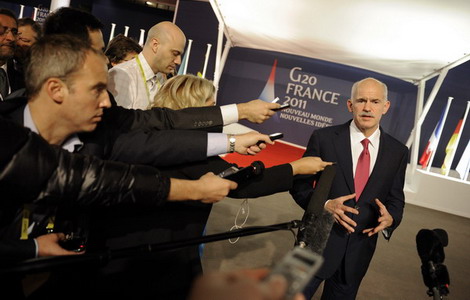

- Greek PM under pressure to quit

- China to build manned space station around 2020

- Hu attends G20 summit in Cannes

Hot Topics

Libya conflict, Gaddafi, Oil spill, Palace Museum scandal, Inflation, Japan's new PM, Trapped miners, Mooncake tax, Weekly photos, Hurricane Irene

Editor's Picks

|

|

|

|

|

|