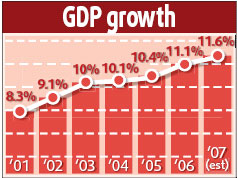

Economy to grow 11.6%, CPI seen at 4.5%

Updated: 2007-12-04 16:35

The economy is expected to grow close to 11 percent next year but inflation will remain a major concern, a top think tank said Tuesday.

Gross domestic product (GDP) growth will be an annualized 11.6 percent this year, the fifth consecutive year that the country would have achieved double-digit GDP growth, according to the annual "blue book" on economic forecasts by the Chinese Academy of Social Sciences (CASS), which was released Tuesday.

The consumer price index (CPI), the main gauge of inflation, has risen strongly in recent months, reaching a decade high of 6.5 percent in both October and August.

The CASS forecast it may be an annualized 4.5 percent this year and 4 percent next year.

"The first priority for China's macro control policies in 2008 should be to contain the fast rises in consumer and asset prices and ease inflationary pressure," the book said.

The trade surplus is expected to widen to $290 billion next year from $260 billion this year, but export growth will slow to 20.5 percent from 25.1 percent thanks to the rising value of the yuan and the government's efforts to rebalance trade, such as cutting export rebates.

Import growth will rise to 22.9 percent from 20.3 percent, the CASS forecast.

The government has taken a series of measures this year to reduce exports, including reducing or canceling export rebates for some products and imposing duty on exports of some resource consuming products.

"They were effective in the first half of this year," said Pei Changhong, director of the CASS' Institute of Finance and Trade Economics. "But figures show that in the second half of this year, those measures have played a decreasing role," he said.

Fixed-asset investment will expand by 25.6 percent year- on-year this year and about 24.2 percent next year, the book said.

The economy may become overheated if the trend continues, warned Chen Jiagui, deputy head of CASS.

Grain and food prices are rising, and asset prices have been driven up with ample liquidity and the negative real interest rate, he said. "It is becoming harder to enforce macroeconomic policies."

Chen said it would be best if economic growth could be kept at about 9 percent next year, but economists forecast that it will be around 11 percent based on the current trend, according to the CASS.

The book suggests that the government slow down economic growth next year through tightening measures. Apart from tightening credit, the government can make use of the drive to save energy use and cut pollutant emissions to improve the efficiency of economic growth.

|

|

|

||

|

||

|

|

|

|