Reform will continue to be a priority

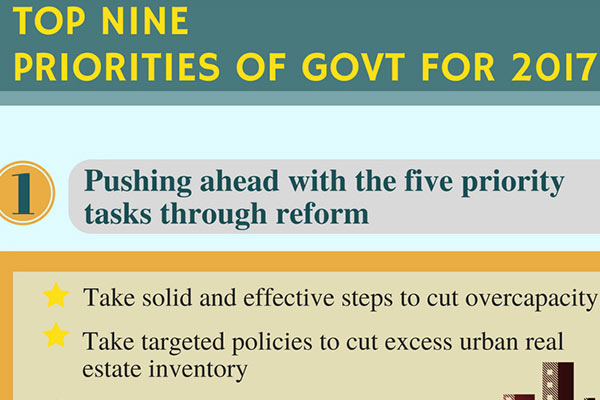

Supply-side reforms will continue to be a priority to improve the quality of the economy, and more attention will be paid to cutting overcapacity and fending off financial risks in the property market, according to leading economists.

Liang Hong, chief economist at China International Capital Corp, saw positive prospects for the near-term outlook in the light of February's factory growth data which beat market expectations.

She cited data from the National Bureau of Statistics, where the Purchasing Managers' Index registered 51.6 in February-a reading above 50 suggests expansion while one below indicates contraction.

New orders from customers-one of five major PMI indicators-rose by 0.2 percentage points to 53 percent in February, data showed.

External and internal demand rebounded more significantly, according to Liang. The export orders index rose 0.5 percentage points to 50.8 percent, and the import index rebounded 0.5 percentage points to 51.2 percent.

With promising signs appearing, Liang suggested that the government should further lower the tax burden on enterprises this year and strengthen the value-added-tax system.

Zhao Yang, chief China economist at Nomura International, expects the government to extend efforts to cut capacity this year, widening the scope to sectors such as cement, electrolytic aluminum and shipbuilding.

Last year, Beijing mainly focused on cutting overcapacity in the coal and steel sectors, and Zhao said it is easier for the government to reduce capacity in industries dominated by State-owned enterprises because any reductions may be preceded by consolidation of SOEs in targeted industries.