Love and fear of Chinese investment

Updated: 2011-09-10 11:38

(Xinhua)

|

|||||||||||

|

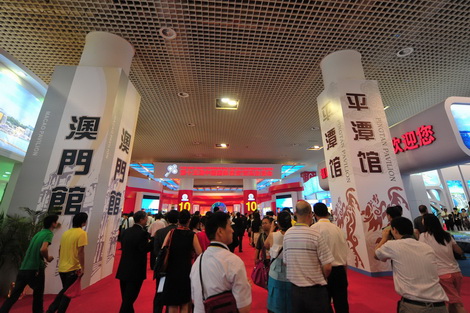

Visitors are seen during the 15th China International Fair for Investment and Trade in Xiamen, southeast China's Fujian Province, Sept 7, 2011. The five-day fair, kicking off on Wednesday, attracts exhibitors from 108 countries and regions.[Photo/Xinhua]

|

XIAMEN-- "Select USA!" A US commerce delegation chief told participants at China's largest investment and trade fair. For the debt-ridden Uncle Sam, China may represent money and hope.

At the 15th China International Fair for Investment and Trade (CIFIT), which opened Wednesday in the southeastern city of Xiamen, nations are extending their "olive twigs" to Chinese investors.

Andrzej Juchniewicz, director of the China Representative Office of Polish Information and Foreign Investment Agency, said Poland's geographic location at the center of the European Union provides convenient transportation and well-educated labor that match Chinese businesses' preference of investing in auto making, manufacturing and IT industries.

"We are looking for Chinese investors. Actually many excellent Chinese enterprises, such as TCL, AOC and SANY Group have made great achievements in Poland. They sell their products across the EU," he said.

"Companies invest in America because it represents the world's largest fully developed single country economy, and our labor pool is one of the best educated, most productive, and most innovative in the world," said Barry Johnson, executive director of Select USA, the first US government initiative aimed at attracting foreign investment, at a forum during the CIFIT.

"We have welcomed Chinese firms, continue to wish them well, and heartily hope that other Chinese companies will see their success and follow them to the United States," Johnson said.

According to a latest report released by the Ministry of Commerce (MOC), China's outbound direct investment (ODI) surged 21.7 percent year-on-year to $68.81 billion in 2010, growing for the ninth straight year and recording an average annual growth rate of 49.9 percent.

Last year's ODI accounted for 5.2 percent of global capital flows and exceeded the ODI of both Japan and the United Kingdom for the first time to become the fifth largest in the world.

Decades of booming trade has allowed China to accumulate the world's largest foreign exchange reserve, which has accelerated its pace of overseas investment.

Chinese investment in the United States is beginning to grow dramatically. Between 2005 and 2010, China was the fastest growing source of foreign direct investment (FDI) in the United States, Johnson said.

"Though the total stock of Chinese FDI in the United States now equals almost 6 billion, we in the US see significant room for growth," he added.