|

Jamie Dimon, chief executive officer of JPMorgan Chase & Co (center right), walks out of the US Treasury building in Washington. Bloomberg |

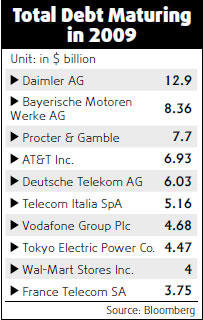

Procter & Gamble Co., the world's largest consumer products manufacturer, and luxury automaker Daimler AG may pay hundreds of millions more in annual interest this year as they prepare to refinance debt with borrowing costs at their highest since the 1990s.

Non-financial companies may replace $135 billion of bonds in the US in 2009, a 55 percent increase from the previous year, according to Bank of America Securities LLC in New York. They'll likely pay $6 billion more than they would have a year ago, eroding profits during a deepening global recession. Corporations will also have to compete for investors with $2 trillion in planned borrowings by the US Treasury and banks including JPMorgan Chase & Co. with government guarantees on their debt.

"There are only so many dollars to invest," said David Ader, head of United States interest-rate strategy at Greenwich, Connecticut-based RBS Greenwich Capital, one of the 17 primary dealers of US government securities that are obligated to bid at Treasury auctions.

The Federal Reserve, led by Chairman Ben Bernanke, is focusing on pushing down the spreads between record-low Treasury yields and consumer and corporate debt.

At the same time, yields on corporate bonds may be pushed higher by an increase in benchmark Treasury bond rates forecast by analysts in a Bloomberg survey. Yields on 10-year Treasury notes may rise as high as 3.1 percent in the fourth quarter from 2.46 percent, according to the survey of 63 economists.

Higher rates

The average US corporate bond trades at 7.7 percentage points more than Treasuries, so a rise in government-debt borrowing costs may produce 10.8 percent yields on corporate bonds on average, according to Bloomberg data.

A year ago, corporate yields were about 4.2 percentage points lower at 6.6 percent, according to Merrill Lynch & Co data. The difference amounts to almost $6 billion on $135 billion of bond sales.

Interest expenses as a percentage of earnings before interest, taxes, depreciation and amortization this year may exceed the third-quarter's 9.4 percent at US companies, said Diane Vazza, an analyst at Standard & Poor's in New York.

Profits on the Standard & Poor's 500 index may decline 11 percent in the first quarter and 6.2 percent in the next three months, according to analyst estimates compiled by Bloomberg. European earnings may decline for all of 2009, and Asian profits may deteriorate further as the global recession deepens.

More competition

The race for funds is pitting corporate issuers against the US, UK, and Germany, which are selling bonds to pay for fiscal stimulus plans, as well as financial institutions such as New York-based Goldman Sachs Group Inc. and American Express Co selling government-backed securities.

Investors are demanding yields relative to government debt near December's record high of 6.56 percentage points for investment-grade issuers in the US after the worst financial crisis since the Great Depression shook confidence and sent government borrowing costs to historic lows. Interest rates on investment-grade bonds hit their highest level since 1991.

"The new-issue premium is large and seemingly larger for the next deal," said Tim Barker, London-based head of credit research at Aviva Investors, a unit of the UK's second-largest insurer that manages about 2.4 billion pounds ($3.6 billion). "To get the deals away, they're going to have to be priced cheaper each time."

P&G's debt

Cincinnati-based Procter & Gamble, which at $7.7 billion has the biggest amount of US dollar-denominated bonds coming due this year, paid 3.1 percentage points more than comparable Treasuries in December for bonds maturing in January 2014. In 2004, the company paid 0.57 percentage point over 10-year government debt.

P&G, which at AA- holds the fourth-highest rating given by Standard & Poor's, paid a coupon of 4.6 percent in December, down from the 4.95 percent it paid on the 2004 issue.

The maker of Pampers diapers and Crest toothpaste raised $7.1 billion in 2008. Jennifer Chelune, a P&G spokeswoman, declined to comment on the company's issuance plans. She said the company hasn't had "any difficulty executing recent debt issuances".

Daimler, of Stuttgart, Germany, is facing $12.9 billion in bond redemptions denominated in euros, dollars, yen and pounds, after raising $9.9 billion in 2008.

The automaker sold 1 billion euros of four-year bonds priced to yield 6.8 percentage points more than similar-maturity government notes in December. That compares with a spread of 1.1 percentage points on a sale of 750 million euros of four-year debt in May, Bloomberg data show. Brigitte Bertram, a spokeswoman for the company, declined to comment.

Expanding spreads

Rising yields and expanding spreads compared with benchmarks are making it difficult for all but the safest issuers to sell debt. Lower-rated borrowers that didn't get government aid have been particularly squeezed, said Thomas Deas, vice president of Philadelphia-based chemical maker FMC Corp, which has $45 million of bonds due in 2011, according to Bloomberg data. Deas is also a board member of the National Association of Corporate Treasurers.

Companies ranked below investment grade sold no bonds in Europe and $40.6 billion in the US in 2008, Bloomberg data show. US issuance was less than a third of the 2007 level.

Cablevision Systems Corp., the New York cable-television service, and MGM Mirage, the casino operator controlled by billionaire Kirk Kerkorian, are among high-yield companies with the most debt maturing in 2009, according to Bloomberg data.

The Las Vegas-based company has $1.28 billion in bonds due, Bloomberg data show. MGM plans to refinance the debt by drawing on its credit lines with banks or by issuing new bonds, Chief Executive Officer James Murren said in an interview.

Cablevision's debt

Bethpage, New York-based Cablevision, which has $1.4 billion in bonds due next year, declined to comment on its plans, spokeswoman Kim Kerns said. On Nov 6., Chief Financial Officer Michael Huseby said the company could pay back the debt using its existing cash, a line of credit and cash flow.

Company borrowing costs soared even as central banks worldwide embarked on the deepest-ever series of interest-rate cuts to free up lending after the September bankruptcy of Lehman Brothers Holdings Inc.

The Federal Reserve cut its target rate for overnight loans between banks from 2 percent in October to a range of zero to 0.25 percent.

US lenders tapped the bond market with $100 billion of dollar-denominated debt backed by the Federal Deposit Insurance Corp last year, according to Bloomberg data. The UK, France and Spain also guaranteed bank debt to unfreeze the new-issues market after Lehman's collapse and about $1 trillion of losses and write-downs at banks worldwide.

More sales

Government-guaranteed sales dominated issuance in the fourth quarter, with Bank of America Corp selling $19.9 billion of FDIC-backed notes. With more stimulus measures planned, the dominance of bank issuance may continue into 2009, according to Stephen Jones, co-head of corporate origination in Europe, the Middle East and Africa at Barclays Capital.

The government-backed bank-bond market in Europe has already kicked off for the year, with issuers including Societe de Financement de L'Economie Francaise, the Paris-based agency that raises money and funnels it to French lenders, and Commerzbank AG, Germany's second-biggest bank, planning sales.

"It's not a compelling environment for issuance," said John Lonski, chief economist at Moody's Capital Markets in New York.

Stimulus plan

US President-elect Barack Obama, who takes office January 20, is asking Congress to act on an economic stimulus plan that may cost $775 billion.

Together with the $700 billion bank-rescue bill, the government may have to borrow as much as $2 trillion in the 12 months ending in September, Treasury Assistant Secretary Karthik Ramanathan said December 10. That compares with $892 billion in notes and bonds sold a year earlier.

The amount of bonds that need to be refinanced may be offset as high interest costs encourage companies to retire debt where they can, according to a January 5 report by Deloitte LLP.

Almost two-thirds of UK companies plan to reduce debt levels in 2009 by cutting dividends, raising equity and curbing spending, according to Deloitte's quarterly survey of chief financial officers.

"Today, the view is that corporates have too much debt," said Ian Stewart, a London-based economist at Deloitte.

December decline

Borrowing costs have fallen from December's record highs, relieving some of the strain on companies needing to refinance. Yields over benchmark rates on US investment grade debt fell 0.52 percentage point from a record 6.56 percentage points on Dec. 5 to 6.04 percentage points on Dec. 31, according to Merrill Lynch's US Corporate Master Index.

Spreads started 2008 at 2.05 percentage points. In Europe, spreads fell 0.08 percentage point from a record 4.38 percentage points on Dec. 26, according to Merrill's European Investment- Grade Corporate index.

The debt of governments and the highest-rated companies were among the best investments in 2008, according to Bloomberg data.

For the year, US bonds of all investment-grade ratings lost 6.8 percent on average, the worst performance in at least 35 years, Merrill data show. The extra interest investors demand to own the debt rather than Treasuries of similar maturity almost tripled. Overall yields are about two percentage points higher than a year ago, according to Merrill data.

Agencies

(China Daily 01/12/2009 page11)