Chinese consumers commonly regard France-based Carrefour's launch of its first China hypermarket in Beijing in 1995 as the debut of foreign retail chain enterprises in the nation.

When the store opened, it was the first time many Chinese consumers could select goods from shelves by themselves, see snacks being cooked, and, most important, buy fresh, high- quality goods in a clean, comfortable environment at prices even lower than open markets.

The chain supermarket concept was common for people in developed countries, but was still a novelty for Chinese in the mid-1990s.

The world's largest consuming group could not imagine that over the following decades China would become a most white-hot competition arena for domestic and foreign chain retailers.

Market liberalization

"It (Carrefour) was so amazing - a spacious and bright store, light music, numerous commodities, colorful tags and magical cash machines," recalls Beijinger Liu Bingyan, 50, adding that the crowds of shoppers at Carrefour during weekends often caused traffic jams around the store at the time.

However, the first batch of Carrefour stores in Beijing, Shanghai, and Wuhan did not abide by Chinese law; they were not registered with the Ministry of Commerce and simply received nods from the local governments. Furthermore they were all wholly owned by Carrefour.

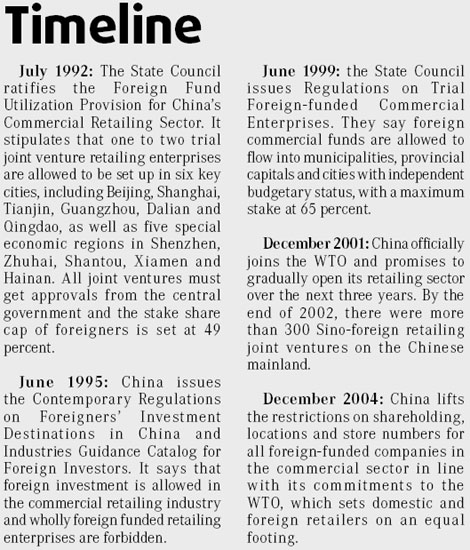

China issued a provision in July 1992 that one to two trial joint venture retailing enterprises would be allowed in six key cities, including Beijing, and five special economic regions. It stated that all the joint ventures must get approvals from the central government and the stake share cap of foreigners was 49 percent.

But the bold French retailer could not wait, eyeing the untapped market which was still dominated by State-owned retailers that had grown up under a planned economy.

In this case, the early bird truly caught the worm. Carrefour - the world's second largest retailing group - is also the most successful foreign retailer in China by number of outlets and sales.

Now, it has 114 hypermarkets across China with 30 billion yuan in annual revenues.

Since 1996, a group of foreign operators, including world's No 1 retailer Wal-Mart, Japan's Ito Yokado, Tesco of the UK and Thailand's Chia Tai also set up shops in China via joint ventures. The joint venture model has provided shortcuts for both sides in terms of operation experiences, management mechanisms, purchase and sales networks, as well as local and global marketing know-how.

"The foreigners' booming entry was accompanied by China's step-by-step liberalization of its retail sector," says Huang Guoxiong, a professor of economics with Renmin University of China.

In June of 1999, the State Council issued Regulations on Trial Foreign-funded Commercial Enterprises, which stipulated that foreign commercial funds were allowed to flow into municipalities, provincial capitals and cities with independent budgetary status, with maximum stock share set at 65 percent.

China officially joined the WTO on December 11, 2001 and promised to gradually open its retailing sector over the next three years. By the end of 2002, there were more than 300 Sino-foreign retailing joint ventures on the Chinese mainland.

The country lifted the restrictions on shareholding, locations and store numbers for all foreign-funded companies in the commercial sector on December 11, 2004 in line with its commitments to the WTO, which sets domestic and foreign retailers at the equal competition platform.

Domestic competition

"Domestic players made fast progress during the period, because they learned from foreign counterparts and national market-oriented reforms were under-run," says Huang.

A group of Chinese retailing giants, such as home appliance retailer Gome, Shanghai Brilliance (Group) and Beijing Wu-Mart, were formed via organic expansion or merger and acquisitions (M&As).

Wang Zongnan, former president of China's top commercial group Shanghai Brilliance and former chairman of Lianhua Supermarket, a subsidiary of Brilliance, says that Lianhua has received great benefits from neighboring Carrefour. Lianhua's first supermarket in Shanghai is side by side with Carrefour's hypermarket.

"The neighborhood facilitated us learning from the foreign giant. It added to our advantages regarding domestic market knowledge and sound local government relations have also accelerated Lianhua's development," he says.

Currently, Hong Kong-listed Lianhua has more than 3,000 outlets nationwide as hypermarkets, supermarkets and convenience stores.

Foreign retailers also found they were faced with stiff local competition from the likes of Wu-Mart in the Beijing region and Lianhua in Shanghai.

"Some giant local retailers are extremely powerful," Eric Legros, CEO of Carrefour China says, "You cannot forget that a local retailer that dominates the region like Beijing is working in a market that is the size of Spain."

Access Asia estimates that between 1999 and 2006, China's total retail market grew 157.41 percent in current terms to 4.16 trillion yuan - representing an annual average growth rate of 19.68 percent over that period.

Access Asia is the first clearinghouse to track the expertise and current research of specialists on policy-related issues in Asia and established by National Bureau of Statistics Research.

Sources from the Ministry of Commerce say though foreign retailers have expanded in China quickly over the past two decades, domestic retailers still occupy large part of the Chinese market. Among China's top 100 chain retailers in 2006, only 18 were overseas enterprises, while only three, including Carrefour, were ranked in Top 10.

Second-tier cities

"It is not an easy (developing) route in China, but it is real exciting," G L Shereau, former president of Carrefour China, said, when he left the eight-year position in January.

The French retailers' law-breaking expansion was on the rocks by 2002. The Ministry of Commerce urged Carrefour to overhaul 27 chains in China, and said that only if it slashed its stakes in China to abide by government caps on foreign ownership would it be allowed to open new stores.

The two-year overhaul that followed made Carrefour postpone development while competitors such as archrival Wal-Mart made fast progress.

But Carrefour recovered fast and began its second and third-tier city expansion.

Besides serving relatively wealthy clientele in Shanghai, Beijing and Guangzhou, both Carrefour and Wal-Mart have also expanded into less prosperous regions in central and western China.

Carrefour opened a store in Urumqi in China's westernmost Xinjiang Uygur autonomous region that borders Central Asia in 2004 and located its 1,000th outlet in the world in Tongzhou in rural Beijing.

Carrefour's Legros says nearly 40 percent of Carrefour stores are in secondary regions in China.

"Since the beginning we have developed stores in both the richer coastal zones as well as in the interior zones where urbanization trends are stronger," Legros says. "This has allowed us to build our expansion toward the future."

US-based Wal-Mart's second-city accession started in Nanchang in Jiangxi province in 2003 and, in December of 2006, it opened its 100th global superstore in the city of Loudi, in the impoverished province of Henan.

"First-tier cities are obviously a very important marketplace, but they are becoming very saturated," says Shawn Gray, vice-president of operations of Wal-Mart China, adding that the second- and third-tier cities present a very good growth opportunity for Wal-Mart in China and Wal-Mart will, where appropriate, expand into these markets.

Though some insiders have predicted that many foreigners would seek independence after full market liberalization, most foreign retailers maintained their existing relationships with local partners.

"More foreign retailers opened new stores through M&As with local partners because of the good locations they have," points out Li Fei, a professor with the School of Economics and Management at Tsinghua University. He adds that foreigners may depend on their Chinese partners to gain low-risk and low-cost access to business networks.

"The Chinese market is a mix given its vast territory. Thus, it is more efficient and safer for foreigners to obtain help from their local partners," he says.

Many foreigners are looking to expand through the acquisition of other retail chains, as Wal-Mart did early last year when it acquired a 35 percent share in 101 Trust-Mart stores owned by a Taiwan retailer.

In 2006, 18 foreign retailers enjoyed an average growth rate of 15 percent in the number of new stores opened in China. Carrefour featured a 53 percent rate, the highest among all foreign peers.

Wal-Mart last year earned 15 billion yuan sales in China and the number of Chinese stores climbed to 71.

Consumers' progress

The foreign retailers' expansion and the progress of domestic players, also helped Chinese consumers become more sophisticated and mature, analysts say.

"They (Chinese) no longer take the big names as an unconditional object of admiration and in turn have come to know how to protect their interests," says Huang with Renmin University of China.

Over recent years, there have been a series of negative reports regarding Carrefour and Wal-Mart as well as domestic Wu-Mart, concerning poor quality or expired food, unsafe children's clothes, maggots found in dried fish, as well as bribes.

Wal-Mart has also been criticized by the public for its refusal to establish a trade union in China.

"Exposure of those scandals reflect a freer social environment, more transparent administration and the fact that consumer rights consciousness has increased in China," says Li of Tsinghua University.

(China Daily 07/21/2008 page2)