In 1979 when Shanghai Television decided to broadcast its first TV commercial, it faced unprecedented resistance and controversy.

At that time TV stations fully relied on government subsidies. Shanghai Television wanted to expand its operations but a limited budget forced it to turn to commercials to generate some revenue. Ironically Shanghai Television even had to apply for an approval from the government to broadcast the commercial at a time when Beijing had the final say on virtually every level of China's economic activities.

Even with government approval, the 90-second commercial for Shenguiyangrong ginseng liquor was almost killed half a minute before it aired. The reason, according to Wang Zhicheng, former head of the advertising department of Shanghai Television, is that many people at the time believed commercials had an unsavory link with capitalism.

"One management team member warned us: 'you will make a huge mistake if it is aired,'" recalled Wang, in a TV program last November.

The controversy over the commercial, now regarded as the first TV commercial in China, underlines difficulties China has had in transforming its planned economy to a market-driven mechanism.

Nowadays broadcasts are flush with commercials. But before 1980s, during breaks in televised sports events, for example, Chinese audiences typically could only see a blank screen or a shot of an ashtray or a cigarette, which meant the audience should take a break.

The Shanghai TV commercial proved to be a big success but sparked an even bigger controversy.

The ginseng liquor was almost sold out within two weeks although it was priced 15 yuan each bottle, a quarter of an average monthly salary of a newly employed university graduate.

But the commercial was criticized as bourgeois because "average consumers" could not afford the product.

In 1980, CCTV, the country's largest TV station, started broadcasting commercials for Coca-Cola and jeans, bundled with foreign programs the station introduced.

The pressure was also big.

"We thought Coke was not targeting the average people, so there was no need to place advertisements. And jeans were regarded as part of the bourgeois lifestyle. How could our TV station broadcast the commercial to promote it?" says Wang Nansheng, former chief of advertising for CCTV.

But the mindsets of Chinese consumers, media organizations as well as business executives were all changing although it was initially a slow process.

The beginning

|

A screen shot of a commercial in 1980s promoting cassette recorders made by Yanwu, a company based in East China's Jiangsu province. The commercial made Yanwu a household name at a time when commercials were limited on TV. |

The first businesses to place commercials on China's TV stations enjoyed almost overwhelming brand awareness as the paucity of commercials as well as TV channels made it easy for consumers to remember their catchphrases.

For instance, the catchphrase in 1984 for the domestic brand Rongwei washing machine was quite simple: "It's all for the love to mothers." At that time with improving incomes, some Chinese families began buying washing machines. Before that housewives had to wash clothes by hand.

However, the controversy over advertising has never ended.

In 1990 actor Li Moran made a commercial for a domestic medicine manufacturer, but it sparked much controversy.

Li who had played a national hero in a film about the Opium War was widely known as a celebrity. Many people believed it was immoral for "a national hero" to make money by making commercials and that almost killed Li's career.

In fact all he got was just a Walkman worth 700 yuan, but the huge pressure from the public forced him to decline all offers for making any further commercials.

Nevertheless, celebrities have frequently appeared in many commercials. Earlier, most commercials, especially those about domestic brands, were poorly designed as many were typically footage of a manufacturer's headquarters or how many medals it had received.

In 1980 Japan's top advertising agency Dentsu Inc opened offices in Beijing and Shanghai and launched a subsidiary in 1994 when Chinese companies started hiring agencies to design and produce commercials. Since then leading global ad agencies such as Ogilvy & Mather entered China.

Rule of law

In March 1993 a document issued by the State council listed advertising as one of the tertiary industries and four months later two ministries issued a guideline designed to boost the advertising sector. In 1995, a law governing advertising took effect.

Introduction of such laws and regulations gave a big boost to the advertising sector which had long been "marginalized", says Yang Peiqing, former president of China Advertising Association.

"The advertising sector has been gaining increasing attention and recognition from the government and the public with the establishment of the socialist market economy after China introduced the reform and opening-up policy," she says.

In 1994 ad sales in China hit 10 billion yuan and that year was a watershed as companies started bidding for time slots and prime time at CCTV.

Kongfuyan, a maker of distilled spirits in Shandong province, became the top bidder of CCTV's time slots by spending 30.79 million yuan in 1995.

Before that Kongfuyan was a small State-owned company and its annual revenue had never exceeded 10 million yuan. But its ads blitz on CCTV helped the firm become a household brand and increased its annual sales to 918 million yuan in 1995.

In 1996 another liquor maker became the top bidder with an ad spending of 321 million yuan and even P&G (Procter and Gamble) joined the bidding war and topped the bidding in 2005 with 385 million yuan.

However, most domestic brands that paid top prices at CCTV eventually collapsed. That underlines companies' "irrational perception of the power of advertising", Liu Xiliang, deputy chief of the former Ministry of Radio, Film & TV during 1991-1997, says.

That has partly led to a decision by the State Administration of Taxation to prescribe that any company should not spend more than 2 percent of its annual revenue on advertising. Due to lobbying by China Advertising Association the percentage was increased in 2001 to 8 percent for some industries.

Industry observers say the advertising market in China could be growing even faster with an increasing industry deregulation.

Some critics say the ceiling imposed by the taxation authorities on advertisers' ad spending is not in line with the market economy.

So far few companies are allowed to spend up to 8 percent of their annual revenue on advertising. The 2 percent ceiling is still imposed on many companies.

Authorities claim the policy was designed to curb tax evasions as many companies had been listing a variety of expenditures as their commercial spending before tax deadlines. Also the policy was aimed at curbing the so-called "excessive ad spending" by companies.

But critics say that underlines a shadow of the planned economy. It could be an unfair practice, especially for start-ups, they say.

Yet the lure to be the top bidder for CCTV's prime time ad spot still has positive effects. "It's when companies fully realized the power of advertising. They realized that without any promotion they would not be able to operate in a market-driven economy, in a planned economy, where there was almost no need for any advertising and promotion," says Liu.

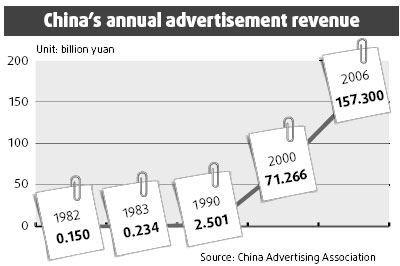

In 2003 the total revenue of China's advertising sector hit 10 billion yuan, 10 times the amount of 10 years ago, according to the China Advertising Association. In 2006, the figure reached 157.3 billion yuan. The advertising sector employed more than 1.04 million people - double that of 1995. The ad revenue by the top four traditional media, TV, newspaper, radio and magazines, totaled at 79.79 billion yuan, nearly five times that in 1995.

In 1995, ad sales accounted for only 0.467 per cent of China's GDP, but in 2006 it already reached 0.75 percent.

Untapped potential

Market researchers say the potential of China's advertising sector has vast potential. The country's ad spending estimated by Beijing-based CTR Market Research is much bigger than the statistics by China Advertising Association.

According to CTR, the spending was 31.2 billion yuan last year, excluding advertising on the Internet and New Media. That represented a 9 percent year-on-year growth, a record low in the past few years. But in contrast, the growth in the United States was only 0.2 percent while in Japan the market decreased 0.8 percent in 2007.

Tian Tao, vice-president of CTR, attributes the slowing growth to the government's curb on advertising on medicines and the trimming of budgets by companies for 2007 in order to prepare for the upcoming Olympics.

"We are bullish about the advertising market. We have every reason to believe the market will get a big boost in 2008 due to the Olympics, the rise of new media as well as the rapid growth of China's consumer market," he says.

Last year online ad sales in China grew by a whopping 48 percent to reach 11.6 billion yuan.

Feng Guangming, chief executive of Beijing Dianyi Advertising Co Ltd, a company focusing on advertising on mobile phones, predicts ad sales in China this year could double that in 2006, based on the feedback from the company's advertisers.

A number of companies are preparing to raise their ad budget for the Olympics.

Li Fucheng, chairman of Yanjing Brewery Co Lt, China's second largest beer maker, says the company could increase its advertising spending by about 130 million yuan this year by targeting Olympic marketing.

(China Daily 03/10/2008 page2)