BEIJING - Outstanding loans to small and micro-businesses made by Chinese banks totaled 16.5 trillion yuan ($2.7 trillion) by the end of July, 1.6 trillion yuan more than that at the beginning of the year, according to data released on Thursday.

The China Banking Regulatory Commission said such lending accounted for 22.5 percent of the country's total outstanding loans.

To further boost financial support to small and micro-sized firms, the commission said it will lower non-performing loans (NPL) requirements for small and micro credits.

A commercial bank's NPL ratio for loans to small and micro firms can be two percentage points higher than its overall NPL ratio, said the commission.

China is implementing a slew of measures to improve its banking services to serve the real economy. Greater support has been given to small firms, which have always been at a disadvantage in raising funds.

Jaguar Land Rover XF Art Edition at Chengdu Motor Show

Jaguar Land Rover XF Art Edition at Chengdu Motor Show

China's chopper industry flying high

China's chopper industry flying high

Models shine at 2013 Chengdu Motor Show

Models shine at 2013 Chengdu Motor Show

Cadillac sexy girls at 2013 Chengdu Motor Show

Cadillac sexy girls at 2013 Chengdu Motor Show

FAW displays Hongqi H7 at Chengdu Motor Show

FAW displays Hongqi H7 at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

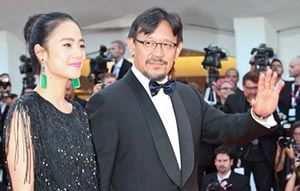

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show