Call for stronger trade ties

Updated: 2011-09-08 11:18

By Wei Tian (China Daily)

|

|||||||||||

Move would ease threat from US and European debt anxieties

|

|

The 15th China International Fair for Investment and Trade (CIFIT) opened on Sept 7, attracting officials, company executives and investors from around the world - including some areas hard-hit by European and US debt problems.

"For sure, it is a global crisis and some countries are affected seriously," said Lithuania's Economy Minister Rimantas Zylius.

"Lithuania's effort will be a good example of how countries adjust to the crisis."

After a huge contraction of its gross domestic product (GDP), Lithuania adjusted its budget and policies to ensure the country remained competitive, Zylius said.

Lithuania's GDP dropped by 15 percent in 2009, during the height of the global financial crisis, but the country expects GDP growth of more than 6 percent this year.

"Countries should not deny a crisis - they should confront a crisis and overcome it," said Zylius, who was attending the fair.

Chinese firms are ready to go abroad and Lithuania is prepared to benefit from such "going-out" behavior, Zylius said.

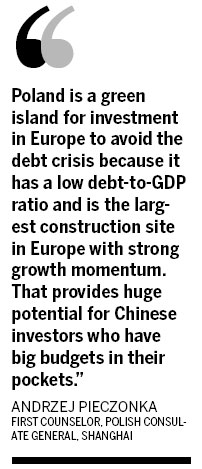

Zylius' comments were echoed by Andrzej Pieczonka, first counselor with Poland's consulate general in Shanghai, who is seeking Chinese capital at the largest investment fair in the world.

"Poland is a green island for investment in Europe to avoid the debt crisis because it has a low debt-to-GDP ratio and is the largest construction site in Europe with strong growth momentum," Pieczonka said.

|

|

According to Pieczonka, Chinese brands such as ZTE Corp, Huawei Technologies Co Ltd and Lenovo Group Ltd are already well known in Poland, which is one of the largest markets in Europe with 38 million customers. He is hoping for investment from China to hit a record level this year.

Moreover, Pieczonka hopes China will invest more in high-tech areas to create high-level job opportunities for Polish workers.

Harley Seyed, president of the American Chamber of Commerce in South China, also said the crisis in the US will have little effect on the country's prospects because Chinese exports play a positive role in creating more jobs for sectors such as transport, retailing and marketing.

Seyed has led the largest delegation with approximately 200 people to the fair and is hoping for 50 percent more contracted investment than the previous year's $2 billion.

Chris Wong, director of Beijing Yingke Law Firm's Hong Kong office, suggested investors in the mainland should get listed overseas via the Hong Kong market to benefit from a simpler process than that of the Shanghai and Shenzhen markets.

"Chinese companies have been experiencing setbacks in their going-out process recently, but Hong Kong still provides a good financing platform for them, and that's a message we want to deliver at this CIFIT," Wong said.

The latest trade figures showed that Chinese exports had jumped by a higher-than-expected 20.4 percent in July, leading to a monthly trade surplus of $31.5 billion, the highest since January 2009.

But, according to Li Rongcan, assistant minister of commerce, overseas demand for Chinese goods remains shaky in the face of debt problems in the United States and the European Union.

"The business environment both at home and abroad for Chinese manufacturers is very complicated and unstable, and there are still many uncertainties," Li said at a forum in Beijing in August.

"The slowdown of the global economic recovery is putting the brakes on the growth of Chinese exports, and the overlapping of the sovereign debt crises with the US and euro bloc is adding turbulence to the world financial markets," he said.

Markku Taulamo, partner of TT Capital Advisors Ltd in Finland, said as a fair to promote trading to pull the world back from the edge of a new downturn, CIFIT should be promoted more in Europe because there are very few people aware of it.

"The European debt is a big issue in Europe currently and we are worried, of course. But China has been very active in the discussions (to solve this issue)," Taulamo said.

Tang Zhihao and Li Jiabao contributed to this story