|

|

|

|

|||||||||

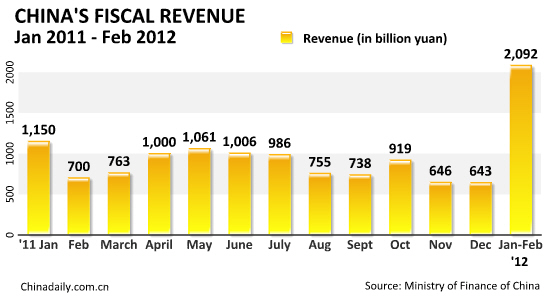

BEIJING -- China's national fiscal revenue rose 13.1 percent year-on-year to 2.09 trillion yuan ($330.27 billion) in the first two months, the Ministry of Finance said Monday.

The annual growth rate decelerated from 24.8 percent recorded last year, but higher than 10 percent recorded in the fourth quarter of last year.

|

The slowdown was caused by a combination of factors, including slowing industrial production, easing price growth, structural tax reduction, as well as sagging property and stock transactions, the Ministry of Finance said in a statement.

Of the January-February fiscal revenue, the central fiscal revenue rose 11.3 percent from a year earlier to 1.06 trillion yuan, while local governments collected 1.03 trillion yuan, up 15 percent, the ministry said.

Of the total, tax revenue increased 9.5 percent year-on-year to 1.85 trillion yuan during the period, and non-tax revenue surged 51.1 percent to 241.69 billion yuan, the ministry said.

In the first two months, the country's value-added tax (VAT) revenue climbed only 1.9 percent from one year earlier to 445.62 billion yuan, because of slower industrial production, mild price hikes and government tax reduction efforts, the ministry explained.

The industrial value-added output, which measures the final output value of industrial production, eased to 11.4 percent year-on-year in the first two months, down from 12.8 percent in December last year, official data showed.

Meanwhile, the Producer Price Index, which measures inflation at the wholesale level, grew only 0.4 percent year-on-year during the period, compared with 6.9 percent last year, according to official data.

As a result, VAT from sectors of oil products, steel products, general equipments, automobiles, and wholesale all dropped, the ministry said.

Furthermore, revenue from personal income tax fell 3.9 percent from a year earlier to 140.98 billion yuan in the first two months, as the country last year raised the monthly tax exemption threshold from 2,000 to 3,500 yuan.

Revenue from turnover tax increased 5.9 percent year-on-year to 293.5 billion yuan during the period, with that from the property sector down 22.7 percent due to sluggish sales.

Stamp duty on securities transactions dropped noticeably, down 37 percent to 4.71 billion yuan.

The growth country's fiscal expenditure accelerated to 32.8 percent in the first two months, in comparison to 21.2-percent growth last year, the ministry added.