Healthy choices gaining traction in nation

If COVID-19 has led to any lifestyle changes for good, then healthy dining would obviously be among the top three.

Food exhibitors at the third China International Import Expo are showcasing low-calorie, high-protein and small portion offerings that quench consumers' needs for customized dietary solutions.

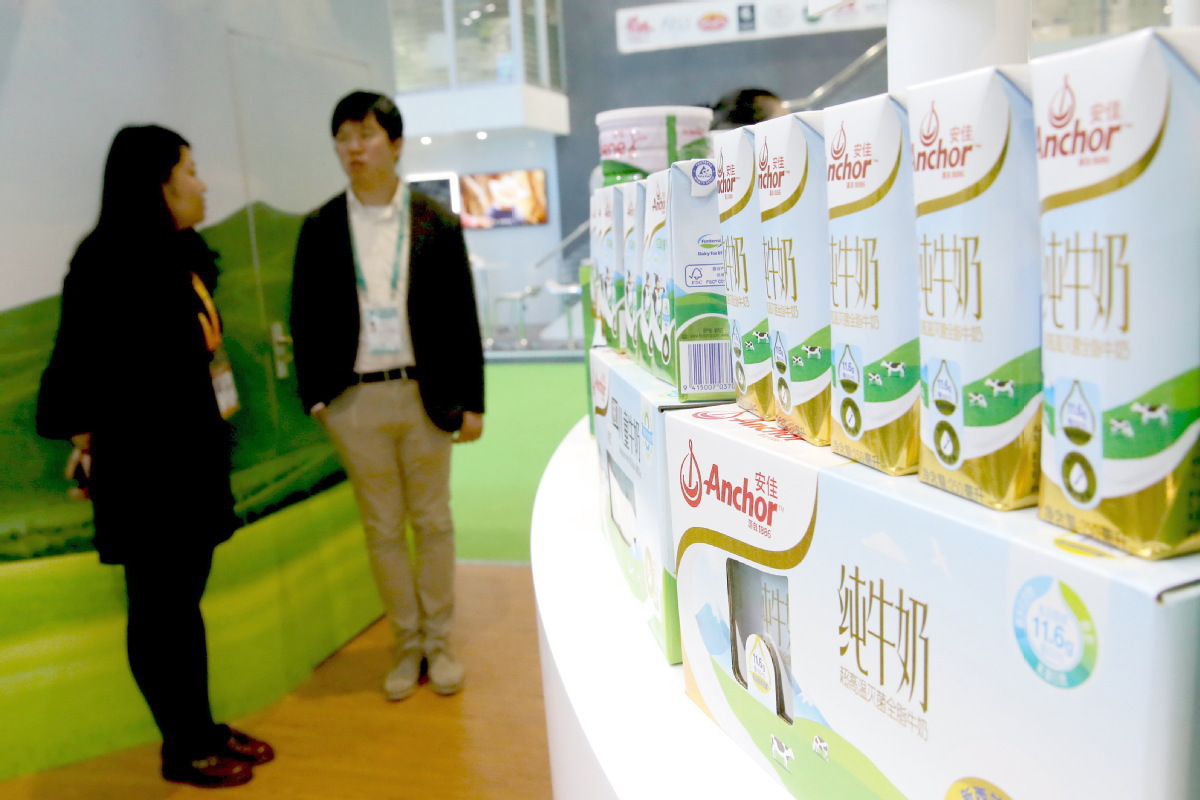

New Zealand dairy company Fonterra has formed a series of partnerships during the CIIE, including for providing ingredients or raw materials for making cheese-derived snacks, probiotics-rich infant formula, as well as meal replacement options.

One highlight of such collaboration was the unveiling of a pop-up store at the CIIE venue with WonderLab, a high-flying meal replacement brand in China that offers bottled milkshakes.

"Chinese customers are looking for healthy, vibrant, segmented and functional items when they choose their dining options," said Ling Jin, director of market development China ingredients at Fonterra China, adding the company has developed two indigenous, patented probiotics that can be used in future product co-creations.

The company is also placing bets on Chinese consumers' surging interest in cheese. Cheese was not commonly consumed in China but has seen strong market potential due to the rising popularity of Western cuisine and innovative dining options such as cheese hot pot and milk tea with cheese topping.

"We are helping our clients develop cheese snacks. It's a relatively unsaturated category in China, with a long tail of cheese segments being untapped in the market. So we are actually part of the customer education process," she said.

Confectionary giant Mondelez International, a three-time participant at the CIIE, is showcasing a bunch of healthy snacks, 60 percent of which have specific health benefits, according to Joost Vlaanderen, president of Mondelez China.

"Health and well-being are an integral part of our strategy, and the pandemic, if anything, has accelerated it," he said. "You still snack, but it's individually-packed and therefore… portion-controlled."

Some of the exhibits gaining traction included chocolates with 30 percent less sugar (compared to conventional level) and low-sodium cookies. Another product is a no-sugar healthy chocolate drink for women, which contains 13 vitamins and minerals and is essential for healthy bones and iron intake.

The Chinese government's directives to "uphold the health and quality of people's lives is music to our ears: it offers opportunities for us as a company and is the right thing to do", said Vlaanderen.

Mondelez is leveraging the burgeoning cross-border e-commerce channels to give imported items a test trial, a practice Vlaanderen called a center of learning.

"A company can't just build a production line for each and every good idea. So, through a test kitchen …such as the cross-border online store, if the products show consumer traction, we might then directly import from here," Vlaanderen said.

The burgeoning channel is poised to satisfy the trade up trend among China's expanding middle-income earner group, according to Michael Jiang, China CEO of Zespri, a world-leading kiwifruit marketer.

"People are seeking high-quality, healthy and convenient options. High vitamin fruits fit well with both the healthy dining habit and the so-called consumption upgrade fashion in China," he said.

Jiang said cross-border e-commerce on fresh produce is largely unsaturated, and one scenario to capitalize on the trend is to turn fruits into gift options.

Agreed Liu Youcai, general manager of Benlai.com, China's largest online fresh grocery market which sources high-quality food products internationally. Liu said sales jumped 70 percent year-on-year in 2020 thus far despite the pandemic, demonstrating strong consumption power, especially in mid-range to higher-end food segments.