Irene wallops floundering flood insurance program

Updated: 2011-08-31 10:45

(Agencies)

|

|||||||||||

|

|

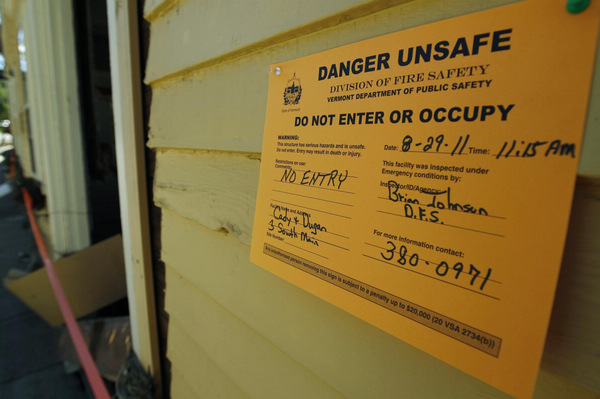

A sign marks a condemned building in Wilmington, Vermont after Hurricane Irene flooded the downtown in this August 29, 2011 file photo. [Photo/Agencies] |

Legal fight ahead

People who were flooded have 30 days from the storm's impactto file claims. When they get paid, though, will depend in largepart on whether the NFIP accepts their claims or not.

One of the problems that is likely to emerge in "Irenecountry" is one that people in Texas, Louisiana and Floridaalready know all too well - the legal conundrum of wind versusflood.Simply put, in many cases an insurer will tell a homeownertheir damage was caused by flood, and to call FEMA. In somecases, FEMA will tell the same homeowner that no, their damagewas caused by wind, and instruct them to call the company thatprovides their homeowners' insurance.

Enter the lawyers.

"There's a big issue under homeowners' insurance, and Iwould say maybe the most common issue, would be causation," saidRobert Berg, an insurance litigator and partner at Michelman &Robinson in San Francisco.

"It's a problem with the legal process. If you have somebodyat your house and they're doing work, a contractor will say'It's not my fault, it's the other contractor's fault.' It's thesame thing."

Berg and other attorneys say the legal issue of causationis, especially after Hurricane Katrina, fairly well defined inthe more traditionally hurricane-prone parts of the country.

But in the northeast, where for some places a hurricane is aonce-a-century event, the case law does not yet exist.

"Because there hasn't been as much litigation in theMid-Atlantic and Northeast as there has been down south, it'shard to say," said Barry Buchman, an insurance litigator withGilbert LLP in Washington.

Michelman & Robinson's Berg said in a situation like this,the law may well be written on the fly.

"If it's really horrific and you get enough attorneysinvolved, then they'll think of ways to create coverage," hesaid.

Struggling to survive

While politicians and lawyers battle over who pays, it's thehomeowners who suffer.

According to catastrophe modeling company Eqecat, Irene wasan unusually wide, wet and slow storm, which made for idealflooding conditions in parts of the northeast that had alreadyexperienced one of the wettest Augusts ever.

For people who live in New Jersey and suffered floodingdamage earlier this year, having to suffer it again - and dealwith insurance claims all over again - may be too much tohandle.

Jonathan McNamara of Fairfield, New Jersey, said his parentsjust got their insurance checks a week ago for flooding fromMarch, and now their home is flooded again.

"They have given us money but getting it is a whole otherstory," said McNamara, 22, who lives with his parents. It's very time consuming and a very frustrating process."

Hot Topics

Li Na FIFA Novak Djokovic Liu Xiang Tiger Woods Yao Ming Rafa Nadal Ding Junhui Dirk Nowitzki Lin Dan Lionel Messi Sang Lan Maria Sharapova Wimbledon Barcelona

Editor's Picks

|

|

|

|

|

|