Nation's tech giant hopes acquisition of US brand can help it take on global strategy GAO YUAN

Lenovo Group Ltd is making cautious yet steady steps to bring Motorola Mobility back to China, the world's largest smartphone market by shipments.

Eight weeks after Motorola showed off its new smartphones to Chinese buyers, the firm, one of the most time-honored mobile phone makers, has already received more than 2 million orders.

"I am very optimistic about Motorola's China performance in the future," Yang Yuanqing, chairman and CEO of Lenovo, told China Daily.

"Bringing Motorola back to China is just our first step to make this brand glorious again."

Like many middle-aged people in the country, Yang, who turns 51 this year, was deeply connected to the Motorola brand. His first featured phone - back in the 1990s - was made by Motorola. Back then, the Chicago-based telecom equipment manufacturer was of the first to sell pagers in China. It also dominated the country's mobile phone market in the early stages.

To some extent, Lenovo's bold $2.9 billion acquisition of Motorola from search giant Google Inc last year was a dream come true for Yang and his team of executives.

"My first phone was also a Motorola," said Liu Jun, senior vice-president of Lenovo, who heads the company's mobile business. "Many people from my generation still carry a strong bond with Motorola, the bond started when pagers were popular."

Falling out of grace in the smartphone era, Motorola quit selling phones in China more than a year ago after it was bought by Google Inc. However, purchasing Motorola and reviving the brand in China makes perfect sense for Beijing-based Lenovo in terms of company strategy.

Although no longer at the center of the global smartphone market, similar to the equally embattled Blackberry, Motorola still has a sizeable following among high-end customers in the United States and Western Europe, where Lenovo is eager to edge in.

Lenovo's adopted son will help the mother company explore development markets in the future. Motorola's decades-long relationships with local telecom carriers will also allow Lenovo access to the high-end smartphone sector, industrial experts said.

The last quarter of 2014 was the first one in which Motorola became fully integrated with Lenovo. Motorola shipped more than 10 million units in that quarter, up by 118 percent year-on-year, according to Lenovo. The better-than-expected sales also added $1.9 billion in revenue.

Nicole Peng, research director at Canalys China, said: "Motorola's continuously improving performance and brand position in 2014 proved that it was a good investment decision for Lenovo a year ago."

Meanwhile, Lenovo's smartphone business also have achieved good results in overseas markets such as Central and Eastern Europe and Southeast Asia in a short period of time, said Peng.

But before Motorola could grab market shares in developed markets such as the US and Europe, it should stop losing money as soon as possible.

Yang, Lenovo's chief executive, reiterated this month that Motorola will return to profit in at most six quarters from now. The brand's performance in China and other emerging markets such as India will also play a critical role in this strategy.

"The challenge for Lenovo is to continue to drive the momentum of the Motorola brand while finding the sweet spot for the Lenovo brand," according to Peng.

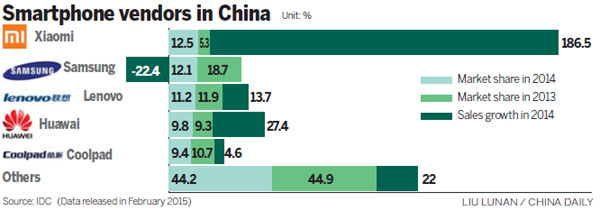

Lenovo is aiming to get back to the top position in the Chinese smartphone market with the help of Motorola. Before Motorola re-entered China, Lenovobranded smartphones had been wrestling with competitors such as Xiaomi Corp and Huawei Technologies Co Ltd. Although Lenovo was the largest local vendor for a while, it was quickly surpassed by redhot startup Xiaomi.

Peng said this year is a critical one for Lenovo as its dualbrand strategy has yet to be proven successful.

"There are opportunities this year for Motorola in China in the medium-high end market, despite Apple's strength. Lenovo has some complex decisions to take to ensure its product portfolio does not compete with the Moto or Lenovo brand," she said.

Lenovo's own devices will cover low and medium-end customers while Motorola will rival Apple and Samsung Electronics Co Ltd in markets above 3,000 yuan.

"I think it is a pretty clear strategy for these two brands. Lenovo has a very close relationship with Chinese telecom carriers," Liu, Lenovo's vice-president, said earlier this year.

"Because carriers are cutting smartphone subsidies, we are shifting our focus to other retail channels this year, especially online sales," he added.

Motorola is adopting its mother company's new marketing strategy as well. It is selling on top online shopping website JD.com in China.

Rick Osterloh, head of Motorola, said it came to China as a challenger. "We are more like a new company in this country despite our long company history," he said.

Lenovo is also trying to make Motorola more of a Chinese company. Its devices are currently manufactured in Tianjin and Guangdong province. Lenovo is planning to move the manufacturing to Wuhan in Hubei province, where the Chinese electronics giant operates its largest phone and tablet assembly facility.

But Lenovo does not seem to be in a hurry to introduce every Motorola product to China. For example, Moto 360, a smartwatch that received wide praise globally, will not be available for purchase in the world's biggest consumer electronics market.

Lenovo's caution may mean it misses the chance of becoming the next big thing after smartphones because the Apple Watch is set to enter the Chinese market by April. Apple's star product will meet no serious challenge in China as Moto 360, arguably the best smart watch in Google's ecosystem, is not ready to make a debut.

Liu, Lenovo's vice-president, said the wearable devices market remains young in China and Lenovo is still trying to find the best way to introduce products.

Introducing Moto 360 is not the top priority for the executives after all. Motorola is set to have a bigger presence in China and the developed economies in the coming years, an important step in Lenovo's strategy to try and take a bite out of Apple's market share.

gaoyuan@chinadaily.com.cn

|

Liu Jun (left), senior vice-president of Lenovo Group Ltd and Rick Osterloh, president of Motorola Mobility, share a cheerful moment during a news conference in Beijing announcing Motorola cell phones' formal return to the Chinese market. Provided to China Daily |