Despite a slow start, year still holds promise

Updated: 2012-02-20 10:45

By Jenny Gu (China Daily)

|

|||||||||

January's 23% drop in auto sales largely due to holidays

Light vehicle sales numbers for the first month of the year were met with disappointment.

|

|

Though a weak month had been anticipated due to the Chinese New Year's arrival in January, it still came as a shock to many.

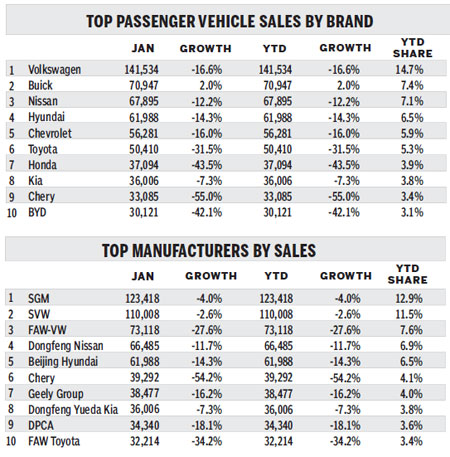

January finished with a 23 percent year-on-year decline to 1.03 million cars sold, while light commercial vehicle figures fell 28 percent to 363,000 units.

As a result, projected sales of light vehicles for the year is now 16.6 million units, down 10.5 percent from the 18.6 million in 2011.

A similar fall in projections happened last February, the month with the Chinese Lunar New Year in 2011.

We believe that inflated sales in January 2011 also exacerbated negative figures for the same month this year.

Most manufacturers hid a good portion of their sales volumes in December 2010 - the end of a strong year - and counted them in January, putting them that much closer to meeting their 2011 targets.

The Chinese New Year in February last year further hiked volumes in January as dealers stocked up for the anticipated holiday sales surge. We believe all these factors compounded to make the market look much weaker than it actually is.

|

|

After the rapid growth in 2009 and 2010, followed by a slowdown in 2011, we believe the market will follow a more organic growth path in the coming years.

Our current forecast for 2012 is that auto sales will grow at a similar rate to 2011, but light commercial vehicle numbers will grow faster.

According to recently published sales targets, manufacturers have an optimistic outlook for the year.

The top 15 carmakers sold some 10.1 million units last year, 77 percent of the overall market.

According to sales targets released by 13 of them, the average 2012 growth rate will be 13.5 percent.

That figure may seem assuring to the industry, but it is well short of the 20.4 percent growth rate projected at the beginning of last year.

Among the carmakers, projections from Japanese manufacturers are the more aggressive, partly due to their need to make up for ground lost in 2011.

European and US brands all expect annual growth rates of 9 to 10 percent.

China's overall economic growth for the year is expected to be moderate, but both consumer and property price inflation have weakened.

Falling inflation has caused the People's Bank of China to lower the bank reserve requirements, signaling a shift in policy away from concerns of overheating towards supporting growth in the face of a weaker global economy.

Together with improving income levels, bank easing will help to raise the vehicle sales rate in the nation's developing areas.