Broadcasting's big challenges

Updated: 2011-12-27 10:02

By Gao Yuan (China Daily)

|

|||||||||||

|

The TV website tudou.letv.com, jointly produced by tv.letv.com and www.tudou.com. Internet and online companies are expected to make money in diverse ways after being integrated with the country's telecommunication and broadcasting networks. [Photo / China Daily] |

Some observers fear TV companies will lose out as telecoms and the Internet face integration

BEIJING - The broadcasting industry could face more opportunities than challenges as the government pushes the integration of Internet, telecommunication and broadcasting networks in the coming years.

Companies in the broadcasting industry could gain profit through more diversified ways after the integration of the three networks, said Yang Mingpin, vice-director at the development and research center of the State Administration of Radio, Film and Television (SARFT).

Broadcasters have to seek new business models that underline the advantages of the industry before the next step of integration begins, according to industry insiders.

The list of the second batch of pilot cities of the three-network integration could come out by the end of the year, reported the Economic Observer in October. China initiated the first step of the integration test in July 2010, when 12 cities were put on trial, including Beijing, Shanghai and Xiamen.

"The biggest advantage for the broadcasters is that they are the generators of the content," said Chen Tao, an analyst at Roland Berger Strategy Consultants. "But they are going to need a bigger stage to display the content. Broadcasters desperately need to introduce new technology and services from other industries."

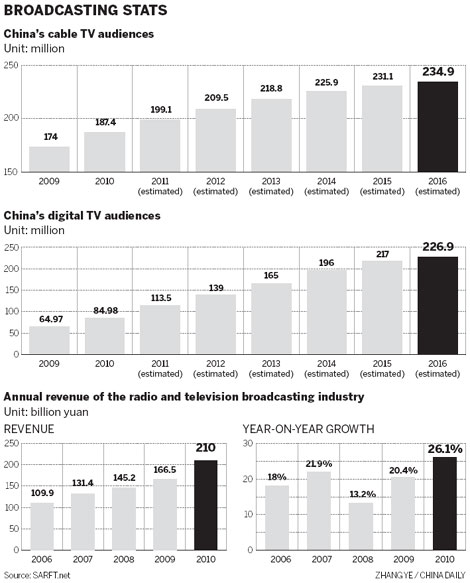

The total revenue of China's radio and TV industry was 210 billion yuan ($33 billion) in 2010, up by 26.1 percent from a year before, said the research website SARFT.net, adding that three media groups have seen revenues of more than 10 billion yuan.

Although Huang Shengmin, dean of the advertising college of the Communication University of China, expected annual advertisement revenues for large TV stations such as China Central Television to hit 50 billion yuan over the next two to three years, the broadcasters will feel dwarfed compared with the nation's telecom giants.

China Telecom Corp Ltd, one of the three telecommunication conglomerates, posted operating revenue of 219.8 billion during the same period.

"The one-way propagation method is dying. TV programs should be transmitted in a more dynamic way that emphasizes interaction between the broadcaster and receiver," said Wang Mingxuan, chief operating officer of Beijing Shandong Technology Ltd, a company best known for its Dopool-series mobile TV software.

Some people are worried the industry could be severely affected after online media and telecom operators link up. They fear traditional broadcasters will struggle to survive.

It's obvious that the integration project will break down the barriers between the three industries. Traditional broadcasters are going to face challenges from outside the industry, such as online video-sharing websites, according to Lin Qijin, an analyst at SARFT.net.

Broadcasters are losing TV viewers in an unprecedented amount. Statistics from iResearch Consulting Group show that the usage rate of TVs in Beijing dropped to 30 percent in 2010 compared with 70 percent three years ago.

"The online video business is maturing as Youku.com Inc, Tudou.com and Sina.com lead the industry while Ku6.com and PPLive follow," Lin said.

Internet-based video services could generate profits in the next three to five years because of the large number of users, Wang from Shandong Technology said.

It seems a good idea for TV broadcasters to team up with video providers on the Web as the traditional TV set becomes "an old-fashioned way" to receive information.

The number of China's Internet users hit 485 million by the end of June, data from the China Internet Network Information Center showed.

In contrast, the nation had 247 television stations covering 97.6 percent of the population by the end of 2010, according to statistics from the National Bureau of Statistics.

In the third quarter, online advertisements helped to generate 1.48 billion yuan of revenue, up by 139 percent compared with the same period of 2010. All the earnings were collected by Internet video websites, including the websites that provide live TV signals, according to Yang from SARFT.

Officials from SARFT said it is not a problem if radio and TV signals will not be transmitted on broadcasting networks after the integration.

"New broadcasting channels, such as Internet protocol television (IPTV), are not regulated by SARFT," said Huang Qifan, deputy-director of the national management service of radio and television satellite direct broadcast at SARFT.

"Although we are capable of building an IPTV network, the cost is high and not economic for us," he said.

However, broadcasters are fully intent on building their own next-generation networks despite the fact that telecom operators and online video distributors had their networks fully established years ago.

Most of the work in building the broadcasting network will be performed by China's only live-broadcasting satellite, Zhongxing No 9.

With the help of the satellite, a new-generation of TV set-top boxes could also be used as mobile phones once a SIM card is inserted. The mobile signal could cover the region without the use of base stations, said Huang, adding that it would be "the best way" to cooperate with telecom operators.

Related Stories

CCTV to be Paralympics Rights Holding Broadcaster 2011-12-13 06:30

Rule to ban ads from intruding on dramas 2011-11-29 07:13

Telecom firms to be investigated 2011-11-10 07:51

Investment in telecom industry plunges in Oct 2011-11-23 15:36

- Toxins found in tainted milk brand product

- CNPC starts exploration of oil field in Xinjiang

- China's Beidou starts providing services

- Shenhua to build thermal power project in Guangxi

- Rubber prices unlikely to bounce back

- China's industrial profits growth slows further

- Natural gas imports expected to increase

- China stresses stable grain production