Market burns dimmer for candle makers

Updated: 2011-12-23 09:39

By Tania Lee (China Daily)

|

|||||||||||

BEIJING - Nothing quite sets the scene at Christmas like lighted candles, which have been a staple of the holiday for hundreds of years.

For China's candle makers, who are the world's largest producers, the rush to cater for this festive season is over.

Now, the focus is on next year - and how to maintain double-digit growth despite China's slowing economy.

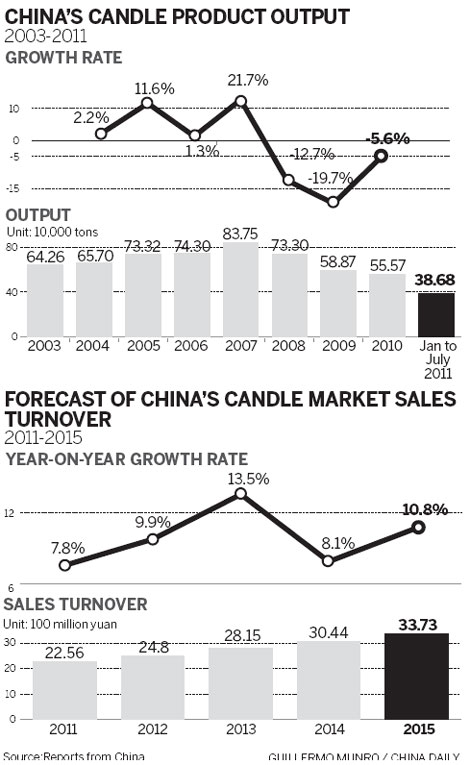

Domestic candle makers' production in 2010 reached 5.78 billion yuan ($915 million) and domestic consumption was 2.09 billion yuan. The European and US markets take up more than 75 percent of production, according to Reports From China, which published a report on China's candle market in August.

The country's largest candle maker, Qingdao Kingking Applied Chemical Co Ltd, relies heavily on these two markets. It sells to Wal-Mart Stores Inc, French supermarket-chain Carrefour SA and Swedish retail giant Inter Ikea Systems BV.

Kingking's first-half revenue was up 50 percent year-on-year to about 430 million yuan.

"Sales in the next few years should be good, but they will be less than last year. We will maintain double-digit growth," said Huang Bao'an, administrative vice-president of Kingking.

A spokesman from the China Candle Association (CCA), who declined to be identified, said that the domestic market is shrinking.

Candles are part of daily life in Europe and the US, where they play a part in religious ceremonies and lifestyles.

In China, candles are usually only needed for "emergency lighting after a disaster, such as the Wenchuan earthquake in 2008. Otherwise, they're used in temples and at birthday parties", said the CCA spokesman.

Chinese candles have one big advantage in global markets: they are cheap. But domestic producers' profit margins are low compared with those of their international peers.

Overseas candle companies with sales channels and a brand image generally have a gross profit margin of more than 50 percent, but Kingking's gross margin is about 20 percent, according to Reports from China.

"In the long term, the company will (also) face greater pressure from anti-dumping (probes), crude oil prices and tax-rate adjustments," the paper added.

At Beijing's Laitai flower market, a salesgirl emerged from a stall full of boxes of candles marked Beijing Candleman Candle Co Ltd. Though the market was busy, the stall was quiet.

"People come to us to buy candles for their weddings, and we supply to hotel chains as well," she said.

"But the peak season was in March and October, after the Canton Fair, where we sold candles to buyers in places like Italy and Spain," she said.

For many Chinese candle producers, the twice-yearly trade fairs in Guangzhou are key events.

"Chinese companies need to look outside the domestic market to generate profit, and the Canton Fair is a good opportunity", said the CCA spokesman.

There are only about a dozen patented candle producers left in China, according to the CCA.

Dalian Talent Gift Co Ltd is China's second-largest candle company, with bases in Dalian, Poland and Thailand.

Its main markets are Europe and the US, and the company counts Ikea and Germany-based Metro AG, the fourth-largest retailer in the world, among its biggest clients.

Despite taking a global approach, "there was not much growth this year compared with last year," said Wang Lixin, Dalian Talent founder and chairman. Wang declined to provide profit figures or growth projections.