Opinion

Analyst: Red-hot China auto market set to cool a bit this year

By Marvin Zhu (China Daily)

Updated: 2010-01-18 08:05

|

Large Medium Small |

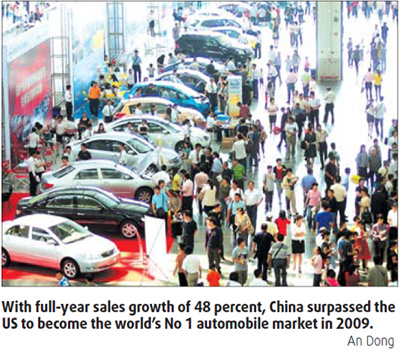

Full-year light vehicle sales figures for 2009 confirm what the industry has known for months - China has formally overtaken the United States as the world's largest vehicle market.

China's sales expanded a remarkable 48 percent over 2008 as passenger vehicle purchases increased 47 percent to 8.73 million units and light commercial vehicle demand expanded 50 percent to 4.25 million units.

Sales set yet another record in December when about 1.35 million light vehicles were sold, an 89 percent increase from a year before.

The strong figures reflect automakers' final effort to boost sales amid booming demand. Shanghai Volkswagen and Shanghai General Motors raced for the top spot. Many other manufacturers ran at capacity to meet backlogged orders and to stock up for increased demand during the New Year holiday.

Manufacturer optimism remains high in 2010. Yet we note an emerging influence posed by the government's hike in the bank reserve ratio to 16 percent, a move aimed at starting to reign in liquidity.

We expect light vehicle sales of 13.9 million units this year, up 7 percent from 2009. Passenger vehicle demand will remain buoyant at 9.6 million units, a 10 percent growth year-on-year, while the light commercial segment is forecast to stagnate after sales were pulled ahead last year by government stimulus policies.

Strong demand in 2009 reduced the need to discount prices to make sales. Overall prices actually increased. Overwhelming demand, insufficient capacity and a shortage of parts were prevalent in 2009.

Interestingly, a closer look reveals that Chinese plants were only 84 percent utilized last year. In a fast-changing market, automakers continue to struggle to have the right capacity in China. While there is not enough supply for hot-selling models like the Honda CR-V and Nissan Tiida, there remains plenty of idle capacity for other slow moving products.

With demand exceeding supply, dealer bargaining power rises. Some even command extra payment from buyers for faster delivery. The practice is likely to disappear this year with growth expected to slow.

Substantial sales of large cars are concentrated in few key models due to limited competition, but the situation is changing. The rise of less expensive domestic brands in the past decade has already prompted foreign automakers to cut prices in the small car segment.

The remarkable growth domestic brands achieved in 2009 raised their confidence to the point they are eyeing expansion into the midsized and full-sized car segments.

With continued improvement in quality and design, market acceptance of local makers in these segments will increase, putting the same downward pressure on prices that is happening with small cars today.

Marvin Zhu is a senior market analyst at JD Power Consulting (Shanghai ) Co Ltd