News

Lower loan target likely for lenders in 2010

By Wang Bo and Mao Lijun (China Daily)

Updated: 2009-12-01 08:02

A bank employee is promoting loan products in Nanjing. China may set a lower loan target for next year. [China Daily] |

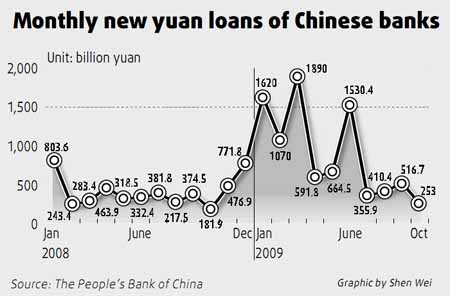

China will set its loan target for 2010 at a level well below the total amount that banks gave out this year on concerns about deteriorating asset bubbles and bad loan problems, sources at the nation's top regulatory bodies told China Daily yesterday.

"The strong tide of credit growth cannot be copied into next year," a source at People's Bank of China, the country's top monetary authority, said.

The official at the nation's top banking regulatory body echoed the tone. "The galloping credit growth this year was an exceptional measure at an exceptional time. The flood will definitely ebb in the coming year," the official at China Banking Regulatory Commission (CBRC), who declined to be named, said.

The government was targeting new loan creation of between 6 and 7 trillion yuan for next year on top of the anticipated 9.7 trillion yuan issued by Chinese banks this year, the Shanghai-based Business News reported, citing an unnamed source at the nation's top regulatory authority.

Tang Shuangning, chairman of China Everbright Bank and former deputy chairman of CBRC, said last week that it would be appropriate for the nation to maintain its new credit level at 7 to 8 trillion yuan next year.

On the eve of the nation's Central Economic Work Conference, the annual gathering of the nation's top economic policymakers to be held in the coming weeks, there has been speculation about the government policy direction next year, as it was struggling to seek a balance between supporting economic growth and averting assets bubbles.

However, the Politburo meeting presided over by president Hu Jintao last week has set the tone for the country's macroeconomic policy next year. It pledged that China would maintain its proactive fiscal policy and moderately easy monetary policy in 2010 in a bid to sustain the nation's economic growth in the post-crisis period.

"For the sake of supporting the economic growth in the coming year, it is not necessary to repeat the credit flood of nearly 10 trillion yuan this year," said Zhang Xiaojing, an economist at the school of economic studies of the Chinese Academy of Social Sciences.

"If the bank loans could be effectively directed into the real economy and add impetus to the industrial restructuring drive, the amount of the loan is not such a big issue for concern," he said.

"However, we think the risk that China ends up having faster loan growth than we envisage now is still relatively high," Wang said.

To be sure, the loan target is just a rough government guideline that might adjust to instant changes in the economic environment.

The government aims to extend at least 5 trillion yuan in new loans this year, but the amount of new loans that was actually issued by Chinese banks has nearly doubled that target.