Auto inventories critically high

Updated: 2012-08-07 14:20

By Gong Zhengzheng (China Daily)

|

|||||||||||

|

A 4S shop in Haikou, where dealers are seeing low sales and excessive inventory. [Photo / Meng Zhongde / For China Daily] |

Overstock at dealers may lead to price war, lower profit margins

Already bloated inventories at automobile dealerships across China - the world's top vehicle market - continue to swell, signaling slowing sales and mounting pressures on both dealers and automakers, according to industry statistics.

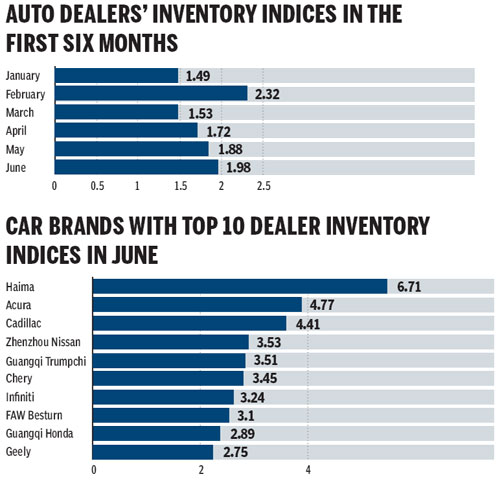

The comprehensive inventory index stood at 1.98 in June, up from 1.88 in May, according to a recent survey conducted by the China Automobile Dealers Association.

The June figure is also the second highest in the first half of this year, the highest being 2.32 in February. The inventory index is equal to the inventory divided by sales in a period. According to international practice in the auto industry, a normal inventory index is between 0.8 and 1.2. If the index exceeds 1.5, inventories have hit an alert level.

The survey covered 41 car brands as well as more than 1,000 4S stores owned by top 100 auto dealers in China.

At 3.12 in June, the inventory index of dealers selling domestic car brands is the highest, followed by imported foreign cars and brands made by Sino-foreign joint ventures.

Dealers of Haima, a domestic brand based in South China's Hainan province, were the ones most seriously hit by excessive inventories. The average inventory index of Haima dealers reached 6.71 in June.

Zhao Chunhong, an analyst from the auto dealer association, said dealers have been strained financially to the utmost degree by excessive offloading of inventory from carmakers and also because of a deceleration in market demand.

As a result of a slowing economy, wholesale vehicle sales in China fell short of expectations by rising only 2.93 percent year-on-year to 9.60 million units in the first half of this year, according to the China Association of Automobile Manufacturers.

More than half of companies in the passenger car sector failed to meet their first-half sales targets. Chery, for example, moved 265,500 cars in the first half, only 38 percent of its full-year target of 700,000 units.

Therefore, carmakers have been pushing their inventories onto dealers in an attempt to boost sales.

China's GDP growth slid to 7.6 percent in the first half of this year from 9.2 percent a year ago.

"Those carmakers whose dealers have high levels of inventory should adjust their production in the second half of this year to relieve pressures on dealers. Otherwise, more dealers will possibly quit," Zhao said.

Some dealers have dropped collaborations with carmakers in the first half mainly due to excessive inventories. In May, four dealers of Sino-Japan joint venture Guangqi Honda Automobile Co quit and another eight suspended operation for a month.

According to a survey conducted by industry consultancy JD Power & Associates early this year, 63 percent of auto dealers in China were profitable last year, down from 81 percent in 2010. Meanwhile, the proportion of dealers in the red surged to 20 percent from 9 percent.

The survey covered 1,605 dealers selling 38 car brands in 59 cities in China.

"The domestic vehicle market is unlikely to rebound considerably unless the government takes major incentive measures to boost demand," Zhao said.

Yale Zhang, managing director of consultancy Automotive Foresight (Shanghai) Co, said the excessive level of inventory is going to be the harbinger of a new round of price wars.

"Price cuts will help boost sales but will further hurt margins of both carmakers and dealers," Zhang said.

In July, Sino-US joint venture Shanghai GM, together with its 500 dealers, slashed prices of the Chevrolet Malibu sedan by as much as 25,000 yuan. The move only came five months after the mid-sized model was launched in the market.

The company has a 2012 sales target of 1.3 million cars. In the first half, it moved 672,000 units.

gongzhengzheng@chinadaily.com.cn