Top Biz News

Metals down after banking surprise

(China Daily/Agencies)

Updated: 2010-01-14 07:57

|

Large Medium Small |

Copper and other metals cut initial losses yesterday after China surprised markets by raising bank reserve requirements and investors assessed whether current demand forecasts were priced in.

"Near-term, the market is worried about tightening... but I think metals will stay at these high prices for most of the first half and the old saying of 'Sell in May and go away' could be correct as interest rates start to rise," MF Global analyst Edward Meir said.

He said copper would trade in a broad range of $6,700 to $7,900 over the next four to six weeks.

Three-month copper on the London Metal Exchange fell 1 percent to $7,379 a ton in early trade, extending Tuesday's 1.5 percent slide. But prices recovered around $100 from an early low of $7,305.

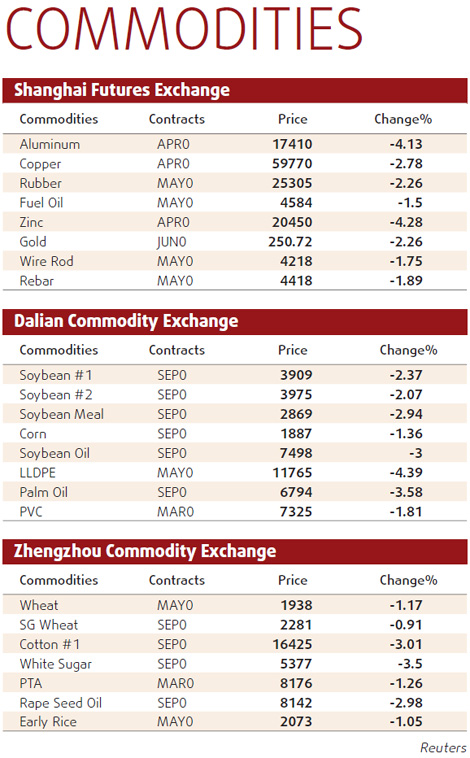

Benchmark third-month Shanghai copper dipped 3.1 percent to 59,760 yuan at the close, having earlier dropped as much as 4.4 percent.

| ||||

The arbitrage window is rising towards levels that prompted record inflows of metal into China in the first half of last year, having spent most of the second half shut.

Commodity and equity markets across the world sold on the China bank reserve news.

But at least one trader saw it as a positive signal for industrial raw materials.

"The knee jerk reaction is to sell," the Singapore-based trader said. "But what this really tells me is that China is booming, it's consuming and growth is back on track. That's a positive from where I stand."

Third-month Shanghai aluminum also pared losses after sliding by its 5 percent limit to 17,085 yuan in early trade.

By the close, Shanghai aluminum stood at 17,305 yuan, down 685 yuan from the previous day's close.

Zinc also recovered ground having dipped to 20,110 yuan, just 25 yuan short of its downside limit.

Morgan Stanley said in a report yesterday that Metal prices may average 32 percent higher this year because of strengthening industrial production, driven by growth in China.